What are structured products?

Structured products are investment products that are puzzling to many investors. We break them down into simple terms, giving a basic overview of what they are, how they are used and what main risks they carry.

Simply put, structured products are a combination of two or more financial instruments designed to facilitate highly-customized risk-return objectives. These normally consist of a traditional investment security combined with derivatives. Once combined, these are a single indivisible product.

As a result, this usually means that the pay-out features of the traditional security are modified. For example, a bond’s periodic coupon may be replaced by non-traditional payoffs which are dependent upon the performance of one or more underlying assets.

Underlying assets can include equities, interest rates, commodities, currencies or a basket of assets. A structured product may offer exposure to more than one underlying asset. If these underlying assets perform as hoped, this can be lucrative for the investor.

Normally, the income derived from these underlying assets is contingent in the sense that if the underlying asset returns ‘x amount’, the structured product pays out ‘y amount’.

As such, there is no cookie-cutter, standardized structured products; the terms, pay-out and risk profile of each of these vehicles is bespoke.

As such, there is no cookie-cutter, standardized structured products; the terms, pay-out and risk profile of each of these vehicles is bespoke.

Structured products are sometimes traded on the stock exchange, such as derivative warrants. Others are unlisted and issued by intermediaries like banks.

Types of Structured Products

The European Structured Investment Products Association (EUSIPA) has created the ‘Derivative Map’ which is widely referred to across the industry. It classifies structured products into three categories:

-

- Capital Protection. Whilst the investor’s original capital payment is protected. Additional returns are dependent on the price development of the underlying asset. These are generally considered to be the least risky type of structured product.

- Yield Enhancement. With this genre of structured products, you receive predefined, fixed coupon payments. No protection for the initial investment is offered and sometimes there is a capped upside potential. However, the objective is to produce a return higher than that of other asset classes that are generally considered less risky, for example, plain vanilla bonds. Although yield enhanced instruments resemble bonds (paying a coupon and often issued at par or at discount), their risk characteristics vary greatly to those of classical fixed income instruments. Yield enhanced products can have inbuilt intricacies that allow certain features to take effect if specific conditions are met during the investment period.

- Participation. These instruments aim to replicate the price development of the underlying asset. They commonly come with leveraged upside potential or downside protection with no or only partial and conditional capital protection. Generally, no coupon is paid on these instruments and they are not issued at discount. These types of structured products are often referred to as ‘certificates’ and often have equities as the underlying asset(s). Some incorporate a ‘return at maturity’ figure which is calculated by multiplying the performance of the underlying asset by a fixed percentage, called the participation rate.

The structured product market is constantly evolving with new and ever-more complex variations of these instruments being created. Thus, some will now fall into more than one of the aforementioned categories.

What is important is that investors understand the terms, investment goal, strategy, fees, procedures, pay-outs and the inherent risk in these products before investing.

As such, many structured products are high risk and are not suitable for inexperienced investors. What is important is that investors understand the terms, investment goal, strategy, fees, procedures, pay-outs and the inherent risk in these products before investing.

Risks

Investing involves many potential risks. Here is a (non-exhaustive) list of the main risks associated with structured products:

-

- A relative lack of liquidity due to the highly customized nature of the investment. As most structured products are unlisted, there is no organized secondary market and at times the holder may not be able to sell the product on at a reasonable price. This is also due to the fact that the product does not perform what is written in terms until maturity date, as embedded derivatives have their own valuation parameters during the life of the product.

- Default risk of the issuing company. Structured products are not protected in the case of issuer insolvency. The creditworthiness of the issuer is therefore an important criterion.

- Market Risk – The market risk corresponds to the risk attached to the underlying asset.

- Foreign Exchange Risk – Some structured products may also be subject to foreign exchange risk whereby fluctuations in exchange rates have a negative effect on the repayment value of the product.

- Embedded derivatives pricing parameters: Most commonly knowns as ‘Greeks’, these are used to measure the sensitivity of the price of derivatives to changes in the underlying asset(s) during the life of the product.

However, despite this, for investors who feel well-versed enough in investing in complex products, these products can offer several benefits, primarily a high degree of flexibility to act upon their convictions.

Benefits

-

- Precision in constructing investment portfolios. Structured products can be built to suit very specific investment needs and objectives. They offer an array of possibilities allowing investors to tailor their exposure to various markets and the potential to make a return in all types of market conditions, with products which respond to falling or rising markets in periods of high or low volatility. Investors can also play on inter-asset correlations.

One of the principle attractions of structured products for retail investors is the ability to customize a variety of assumptions and market expectations into one instrument.

-

- Access. In most cases, it is not feasible for the average investor to hold physical underlying assets such as oil, metals or other commodities and the derivatives market which do offer exposure to these assets is not easy to access and difficult to navigate. Certain structured products are becoming more standardized and more available on major European bourses, for example, bonus certificates and discount certificates. With such instruments investors can participate in markets which would otherwise be difficult to reach, in a cost effective way.

- Nuanced investing. One of the principle attractions of structured products for retail investors is the ability to customize a variety of assumptions and market expectations into one instrument.

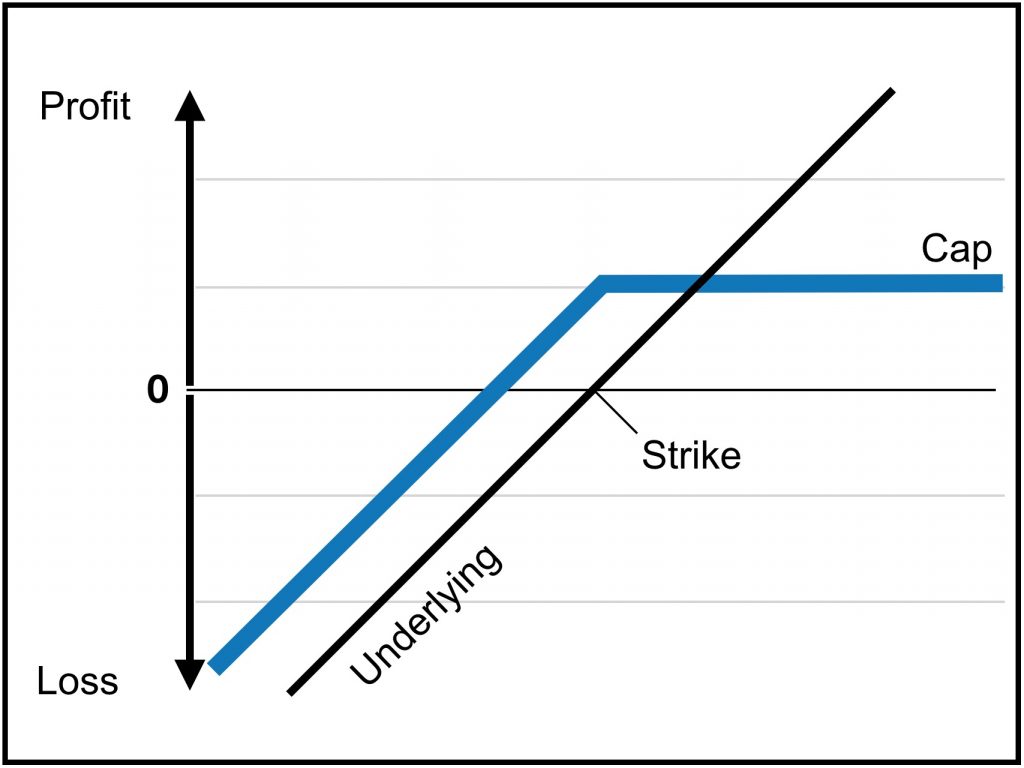

Take for example, discount certificates. These are normally purchased when the investor expects the underlying asset to move sideways or rise slightly. This product allows the investor to acquire the underlying at a lower price (the Strike). Should the underlying close below the Strike at expiry, the underlying and/ or a cash amount is received. This means there is reduced loss potential compared to a direct investment, however, there is also a cap on the upside profit potential.

Discount Certificate

Source: EUSIPA

Regardless of the investment being considered, investors are advised to carefully read the documents listed below before making any investment decision:

-

- PRIIPS and KID documents;

- Product offering document;

- Product key facts statement.

Good buy!

Mortgage

Mortgage Personal loan

Personal loan Savings

Savings