Starting a company: limited liability company or sole proprietorship?

Tom is 34 years old. After 10 years as an employee, he decided to start his own business. The vision for his future business is clear, but legal matters much less so. What will his exact status be? Will he create a commercial company such as a Sàrl, or become self-employed as a sole trader? What do these statuses mean, and what exactly to they imply in legal, employment and tax terms?

Consider both legal and human resources aspects

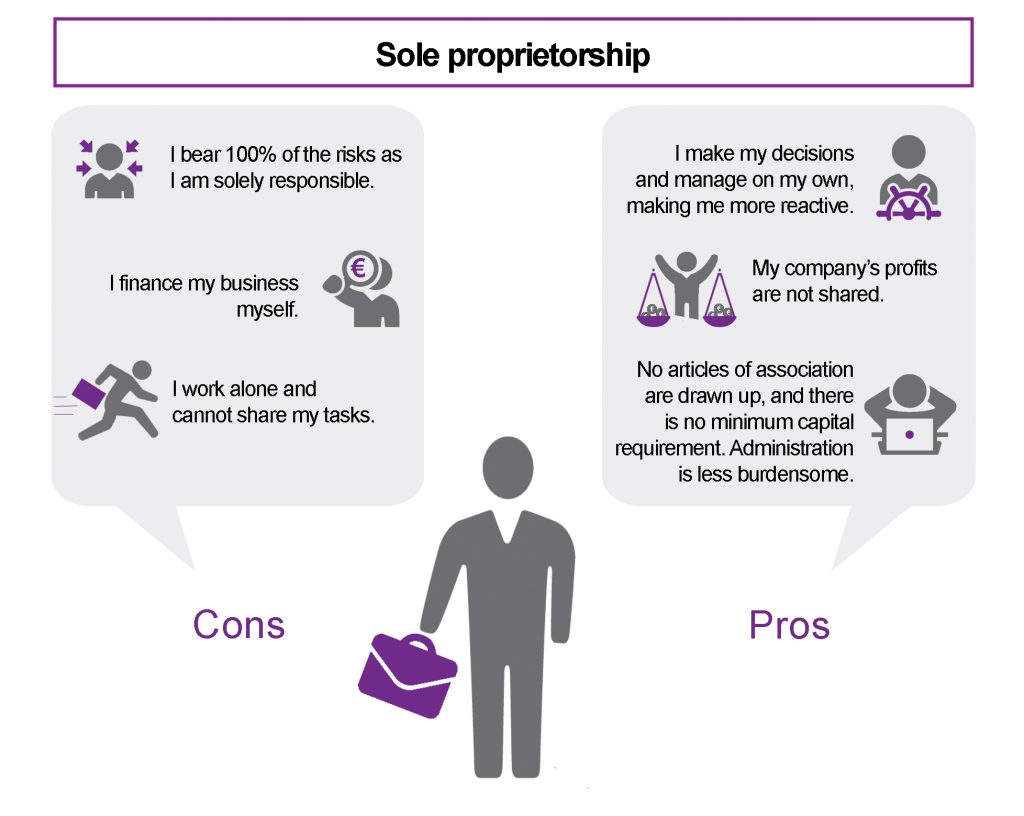

To reach a decision, Tom will have to ask himself the right questions. Does he want to work and make decisions on his own? Would he prefer to call on the experience and resources of any partners? If so, are these partners trustworthy? How much investment would be needed? Is he putting in money of his own? Will this be enough? By answering these questions, Tom will fine-tune his plans and naturally gravitate towards one status or the other.

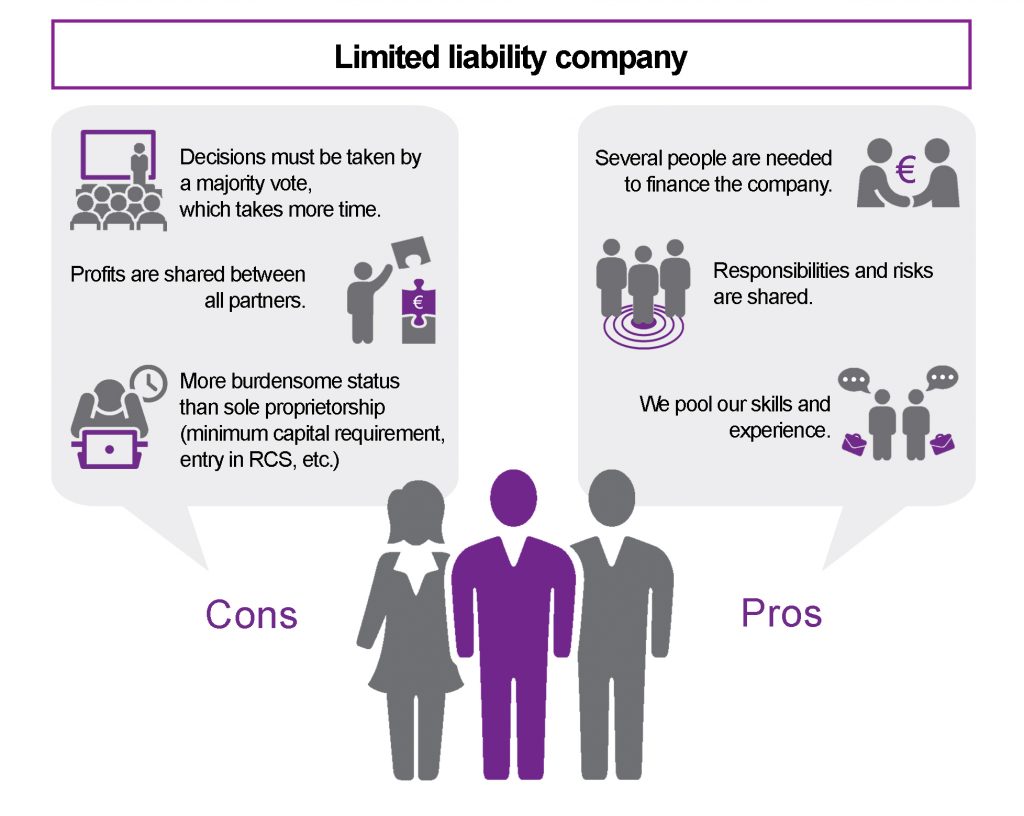

Becoming a sole trader would mean Tom being independent and working alone. With a Sàrl (société à responsabilité limitée – limited liability company), he would have partners and would have to manage his affairs together with them – unless he opts for the single-person Sàrl. To make things clearer and give Tom everything he needs to make the best choice for his future business, we have provided a table comparing the main structural and legal features of a sole proprietorship and limited liability company.

| LEGAL ASPECTS | |

|---|---|

| Sole proprietorship | Limited liability company |

| Single owner with no partners. | Between 2 and 100 partners (1). |

| Except for Sàrl Unipersonnelle: 1 partner. | |

| The entrepreneur must submit a business permit application (except in the case of certain intellectual services). | The entrepreneur must submit a business permit application in order to be able to trade. |

| No deed of incorporation is required | A notarised deed of incorporation is required, along with entry in the Trade and Companies Register (RCS) for publication in the Recueil électronique des sociétés et associations (RESA) and registration of the company. |

| No minimum capital requirement. | Minimum capital of EUR12,000 fully paid up at the time of creation. |

| The entrepreneur is responsible for commitments and debts, with no distinction between private and professional wealth (2). | Partners are liable in proportion to their stake in the company. |

| The entrepreneur must keep transparent books. The annual accounts are not published to third parties. | The following must be approved at a general meeting of partners: balance sheet, profit and loss account, notes and management report (which must all be filed with the Trade and Companies Register). |

| If the entrepreneur dies, the business is subject to inheritance law and could be wound up. | There is no dissolution after the death of a partner, bankruptcy, etc. |

Tom realises that while being a sole trader gives him real independence, it is also a risky choice that makes him personally liable and could see him lose his possessions.

Sàrl status means that resources, skills and risks can be shared between partners, but it is also more burdensome from an administrative point of view.

Consider employment and tax matters

Tom must also think about the employment and tax aspects of these statuses. While there are obligations to be met in both cases, the restrictions are not the same. For example, as a sole trader, Tom is taxed on his own income, whereas with a Sàrl, it is the company that is taxed. Also, there is no wealth tax for a sole trader, but there is for a Sàrl. Employment and tax aspects are summarised below.

| EMPLOYMENT ASPECTS | |

|---|---|

| Sole proprietorship | Limited liability company |

| The entrepreneur must sign up with the social security centre (CCSS) as a self-employed worker (for work covered by the Chamber of Commerce, Chamber of Trades and Chamber of Agriculture + freelance knowledge workers) by completing a self-employed workers’ registration form. | Any manager of a commercial, craft, agricultural or knowledge company who is a partner and holds more than 25% of the company’s shares must sign up with the CCSS as a self-employed worker. However, he must complete the private sector employee registration form. |

| The entrepreneur himself pays employer and employee contributions in proportion to his gross professional income, along with accident insurance. He is exempt from contributions if his professional income does not exceed one third of the minimum annual wage. | If it wishes to recruit employees, the company must submit a form to the CCSS to register as an employer. |

| If the company’s manager (with the business permit) holds less than 25% of the shares, he can be an employee of the company (provided that he has an employment contract and is not the majority partner). He then only pays employee social security contributions, while the company pays the employer contributions. |

| TAX ASPECTS | |

|---|---|

| Sole proprietorship | Limited liability company |

| The entrepreneur must register for VAT with the Luxembourg tax office. | The company must register for VAT with the Luxembourg tax office. |

| He is taxed on his income as an individual (rate of between 0% and 42% depending on the taxable income). | The company is subject to corporate income tax (rate of between 14% and 16% depending on the taxable income). |

| If he makes a trading profit, he must pay a communal business tax (only if he has a trading licence). | If the business makes a trading profit, it must pay a communal business tax (variable amount, depending on the commune). |

| Land tax, if he is a landowner. | Land tax, if it is a landowner. |

| Wealth tax |

In conclusion, Tom realises that there are pros and cons of both situations. In order to make a decision, he must therefore take into account the nature of his business and his personal circumstances. He can also get help from a specialist.

Since 16 January 2017, there has also been the Sàrl-S (simplified limited liability company) status. This is a “Sàrl-lite”, with a minimum capital requirement of just EUR 1 and incorporation possible through a private deed without the involvement of a notary.

If, like Tom, you would like to start out in business, you can obtain a free analysis of your personal situation by contacting the House of Entrepreneurship at the Chamber of Commerce or Business Contact at the Chamber of Trades.

(1) Partners must be chosen carefully: agree on objectives, terms of collaboration, etc. It would be a shame to go under due to a misunderstanding!

(2) If Tom is married, it is highly advisable to adopt the separation of goods matrimonial regime.

Mortgage

Mortgage Personal loan

Personal loan Savings

Savings