Wealth management: make the right decision early

A multifaceted opportunity that requires the relevant know-how.

Can I make that investment without overstretching myself? Could that spending I’m planning potentially jeopardise my future income? Can I afford my dream house? Will I have enough money when I retire to maintain my standard of living? These are all questions that many people ask themselves. They all come under the heading of wealth management and always arise when important projects are lined up or when taking on new challenges in life that have a direct impact on your finances. To make the right decision in such situations, you need to have a clear idea of your wealth, its potential and what to do with it.

The fact is that wealth needs to be managed in a consistent manner and with a longer-term perspective, whether comprised of real estate, financial assets or business property. Successful management first and foremost requires a precise and comprehensive inventory of all the assets and liabilities. The simple rule is, your wealth is equal to the sum of your assets minus all existing liabilities.

Determine assets

The most important assets include real estate (houses, apartments, sites, agricultural land, etc.), liquid assets (bank accounts, deposit accounts, cash, etc.), and financial assets and securities. In addition, life insurance, pension plans, business assets and other valuables (jewellery, art, etc.) are also taken into account.

How they are valued can differ greatly depending on the type of asset. Real estate, for example, is normally valued based on the current market value. The precise value of regular-premium life insurance policies is given in the annual statement. Securities are valued based on current stock prices. The value of participations in open-ended investment companies (SICAVs) is equal to the last known redemption value. For business assets, the market value usually applies.

The purpose of wealth planning is to optimise asset growth.

The purpose of wealth planning is to optimise asset growth. As mentioned above, in order to make the right decisions, it is important to have the necessary skills. And the best way to do this is to seek expert advice. An professional will conduct a thorough consultation with you and run various scenarios for the long-term growth of your wealth. Based on the initial situation identified and taking current and future income and outgoings into account, this can help you analyse your options and, if necessary, run through new models. The solutions should always be tailored to the client’s specific situation, wishes and expectations. It’s therefore important to know what to expect and have a clear idea of your goals. Wealth planning should culminate in a coherent package.

Various degrees of complexity

Wealth management models can take very different forms and degrees of complexity. That goes for possible corporate structures as well as for the asset instruments. The crucial thing is to check all forms and options. Naturally, this requires multidisciplinary skills, especially in the fields of finance, taxation and succession planning. Without the right know-how, it is difficult to give a person – or a household – an exact summary of their current and future wealth and to estimate their capacity to save or ways they can put their capital to productive use. Experts are trained to recognise risks and how to gauge them. This is why their advice on wealth planning is so important.

Wealth planning in five steps

- Inventory: In this step, your finances and assets are determined and assessed.

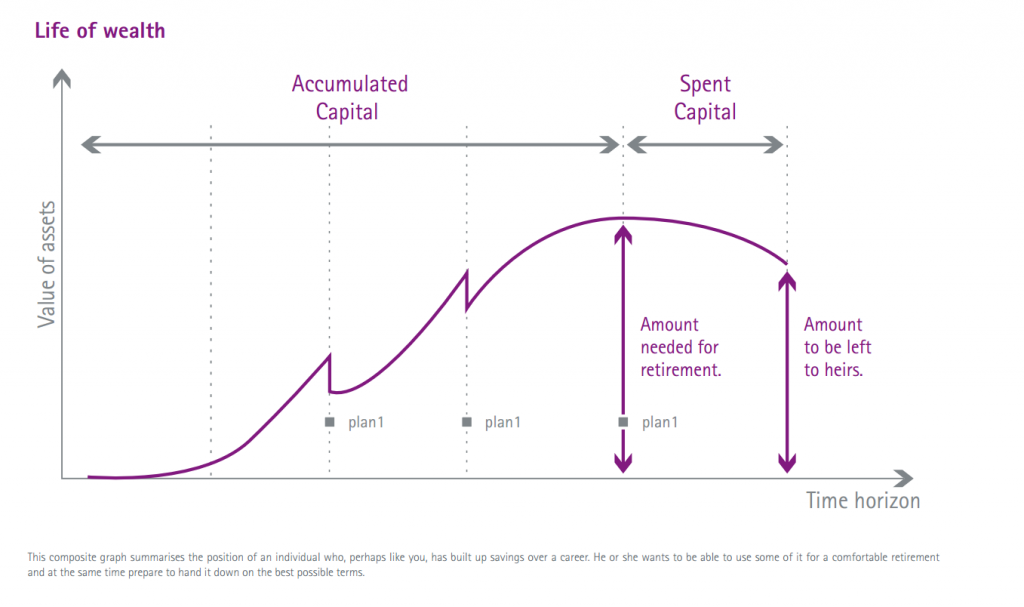

- Set objectives: You define objectives so that the wealth planning process is as comprehensive as possible. The graph below shows a person who has accumulated capital during their working life. They wish to prepare for their retirement while also making sure the transfer of assets is as smooth as possible.

- Position and analysis: Your wealth is analysed once all the data have been collected. Then your financial position will be drawn up and an estimate made of how your wealth is likely to grow in the long term.

- Simulations: The possible solutions for optimising the growth of your wealth are run through. The effect and suitability of these can be checked by running new simulations.

- Development: The economic situation and tax regulations as well as your personal and financial situation may change over time. Therefore, it’s worth taking the time to adapt your wealth planning to these new circumstances every now and then.

Mortgage

Mortgage Personal loan

Personal loan Savings

Savings