Employment: benefits in kind in Luxembourg

Meal vouchers, a company car, parking space, telephone, pension scheme, supplementary health insurance, housing, etc. Benefits in kind are commonplace in Luxembourg. Who receives these benefits? What form do they usually take? How do bonuses work? myLIFE offers a round-up of these little extras that employees love.

Hiring new talent and retaining staff are two of the major challenges facing human resources departments. Although wages remain attractive in Luxembourg, that’s not always enough to motivate staff and ensure their loyalty. For this reason, many companies offer employees a “salary package” which includes benefits in kind and/or bonuses and other incentives on top of a basic salary.

Benefits in kind are often found in the services sector

Benefits in kind are goods or services that are offered to staff members by the employer at no charge or at a reduced rate. Their award is not mandatory and they may be offered to all employees in a company or just a selection. However, they must be mentioned in the employment contract or the amendment to the contract, as they form part of the employee’s remuneration.

→ In principle, benefits in kind are subject to social security contributions and income tax. However, they remain an interesting financial proposition, as the value attributed to the benefits is attractive and they are often partially or fully exempt from tax.

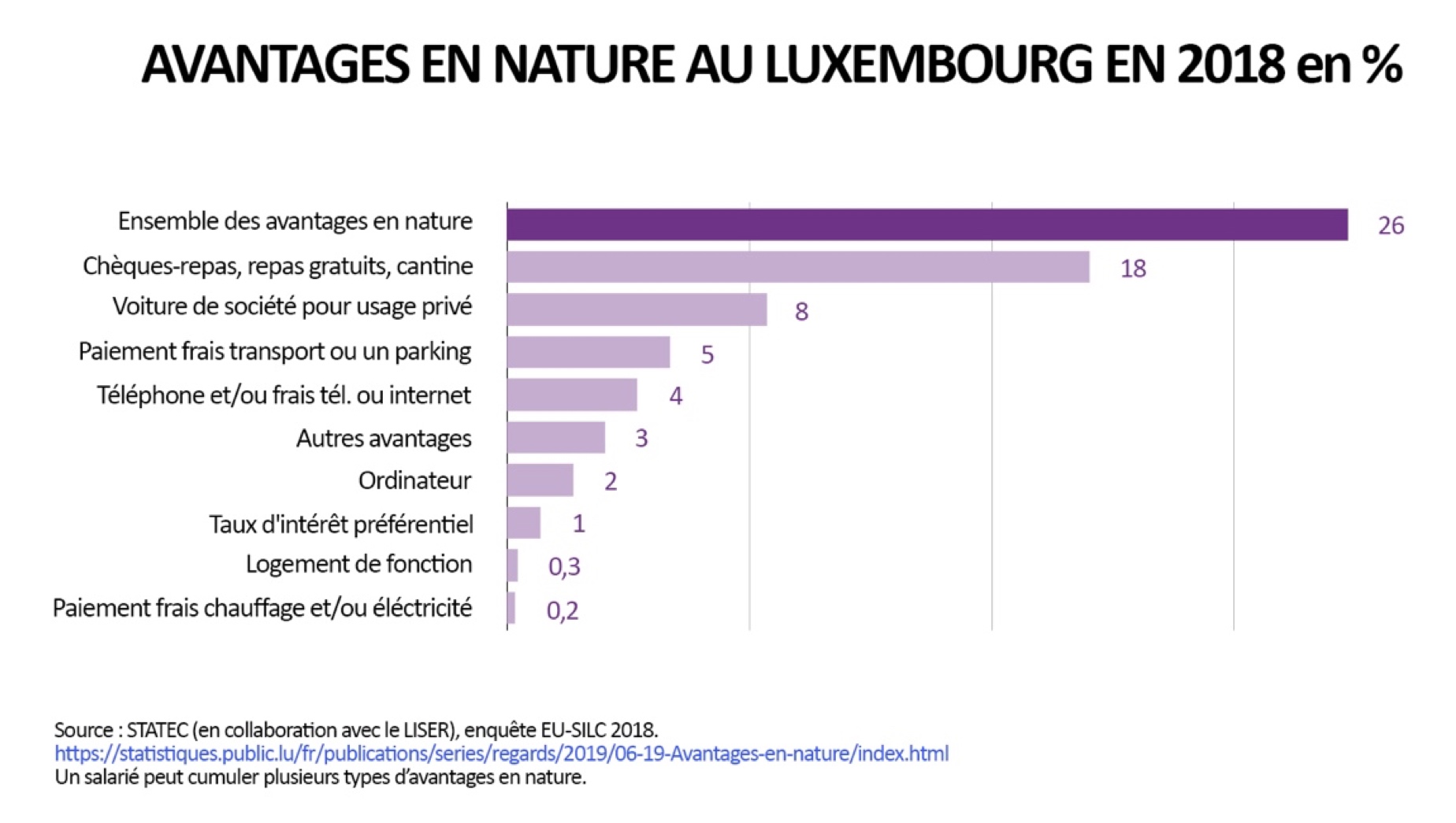

In Luxembourg, a little over a quarter of employees received benefits in kind in 20181, and 48% of these were executives. These salary top-ups were more often provided to company managers or employees in more intellectually challenging professions, and were more common in the services sector: finance, insurance, real estate, science, technology, administration and support.

The most common benefits in kind in Luxembourg include meal vouchers or access to a company canteen, but also company cars used for private travel.

Meal vouchers and company cars in Luxembourg

The most common benefits in kind in Luxembourg include meal vouchers or access to a company canteen, but also company cars used for private travel.

Meal vouchers are an alternative to a company canteen. They can be used in restaurants or to purchase food in bakeries, butchers, grocers and supermarkets in Luxembourg (a maximum of five vouchers a day or EUR 75 a day if paying for a meal or foodstuffs). They are exempt from tax and social security contributions, provided that the employee contributes at least EUR 2.80 per voucher and the maximum face value per voucher is EUR 15 (previously, EUR 10.80).

Note: Luxembourg meal vouchers can only be used domestically, and not in neighbouring countries.

A company car for the employee’s business and private travel is also one of the common benefits in kind. The taxable benefit may be assessed on the basis of per-kilometre running costs (logbook method) or more usually, as a lump-sum benefit based on the CO2 emissions of the car. The lump-sum benefit ranges from 0.5%-0.6% of the value (including VAT) of the car when new for electric vehicles with the lowest emissions, rising to 2% for thermal or hybrid vehicles. The budget allocated to employees for their operational or finance lease is taxed each month along with their salary.

→ The cash value of benefits in kind must be determined to calculate the tax that will be deducted at source. The assessment methods used depend on the type of benefit and are based either on market price, or on lump sum rules set by Luxembourg regulations.

A broad range of options in Luxembourg

According to the EU-SILC 2018 survey, companies have a wide range of options available in addition to meal vouchers and company cars if they wish to top up their employees’ remuneration. They can pay for certain expenses such as the costs for parking, travel, heating, electricity or internet. They can also provide employees with a smartphone and/or a computer, offer loans on preferential interest terms (particularly for staff in the banking sector) or offer foreign workers company accommodation.

Other benefits may include access to a supplementary pension scheme, supplementary health insurance, the payment of school fees for the employee’s children, interest subsidies, the impatriate regime for highly qualified staff, and the profit-sharing bonus that rewards employees who have contributed to the company’s performance.

Remuneration can be topped up with incentives, bonuses, and a 13th month of salary

As well as fixed remuneration and benefits in kind, employers can also reward employees with incentives or bonuses.

This aperiodic income is not compulsory and is considered a favour that employers are free to grant to staff as they see fit.

→ Note: if the bonus is included in the employment contract or the collective agreement (with no mention that it is optional), or if it is considered as permanent, fixed and customary within the company, it can be regarded as a compulsory component of remuneration.

Aperiodic remuneration is not taxable at a higher rate than regular salary. The calculation is just different.

Like benefits in kind, incentives and bonuses such as a 13th month salary payment are subject to social security contributions and income tax. Contrary to popular belief, such aperiodic remuneration is not taxable at a higher rate than regular salary. The calculation is just different.

Taxation on an employee’s bonus will be calculated on the basis of the rate of income tax deducted at source on aperiodic remuneration in Luxembourg. However, if the annual remuneration is above EUR 60,000 and/or the bonus payment exceeds EUR 5,599, the rate of income tax deducted at source on salaries in Luxembourg applies.

| Example:

To make this clearer, we have deliberately simplified the example here by ignoring social security contributions and any deductions on the tax card, and rounding the figures used. A resident employee in tax class 2 (main tax card) receives a salary of EUR 3,500 per month and pays around EUR 86 of tax per month. In December, the employee is paid a bonus of EUR 2,000. The employee will pay around EUR 187 of tax on this bonus. The tax paid by the employee by the end of the year is therefore: (EUR 86 x 12) + EUR 187 = EUR 1,219. It should be noted that taxation of the bonus is higher because the amount of tax is calculated for the year and not for the month. It is as if the employee had received 1/12th of the bonus each month together with their salary. The tax on the bonus takes account of the tax owed on the bonus that must be spread over the other months in the year, since the employee should have paid tax on an annual income of EUR 44,000 ([EUR3,500 x 12] + EUR 2,000) and not EUR 42,000 (EUR3,500 x 12). In other words, if the bonus had been taken into account at the start of the year, the employee would have received: (EUR 3,500 x 12) + EUR 2,000 = EUR 44,000 / 12 = EUR 3,667 per month. The employee would therefore have paid around EUR 103 of tax per month, or EUR 103 x 12 = EUR 1,236 for the year. In conclusion: By paying the bonus of EUR 2,000 at the end of the year, the tax deducted at source for the employee is: (12 x EUR 86) + EUR 187 = EUR 1,219. By paying the bonus spread throughout the year, the tax deducted at source for the employee would be: 12 x EUR 103 = EUR 1,236 Which is a difference of EUR 17. The amount of tax paid is therefore nearly the same. It is simply spread out differently. On its website, the tax authorities give a detailed, real-life example of how a bonus is taxed. |

Finally, it is worth bearing in mind that as well as benefits in kind and bonuses granted by the employer, other factors should be considered such as training sessions, flexible working hours, teleworking, etc. These are key factors when it comes to hiring and retaining staff.

1 Source: Results of a survey carried out in 2018: Regards n°6 05/2019, STATEC.

Mortgage

Mortgage Personal loan

Personal loan Savings

Savings