If budgeting were told as a story

From the first salary to family expenses, through the first rent, alone and later as a couple, delve into the great adventures of household budgeting.

Once upon a time, a young man became aware of his first salary.

“€3,500, it’s too much!”

“Gross or net?”

“Gross or net, it’s basically the same, isn’t it?”

“OK…”

So, he started deducting his social contributions and taxes to figure out what he would get by the end of the month. But since he still lived with his parents, the calculator was quickly put back in the cupboard. Oh, careless youth!

One day, he wanted to seek his independence and an apartment:

“3 rooms, a rent of €1,900…it goes quickly with my salary of €2,800 net!”

In this case, it was the real estate agent who invited him to review his plan. The loft was nice, but the rent shouldn’t exceed a third of his salary.

As for the rest, since he lived alone, the “calculation” was simple:

“Yes, savings, I’ll consider that tomorrow…”

But a new budgetary step was awaiting our young worker. At last, he and his other half…

Ah, love! The flowers, sun, childlike giddiness. Yes, but love also requires a housing savings plan, a full shopping trolley and, sooner or later, an additional room and a budget for crèche. Foresight becomes necessary, you should PRI-OR-I-TISE!

“Can we attach a baby seat to this motorbike? If not, I’m selling it…”

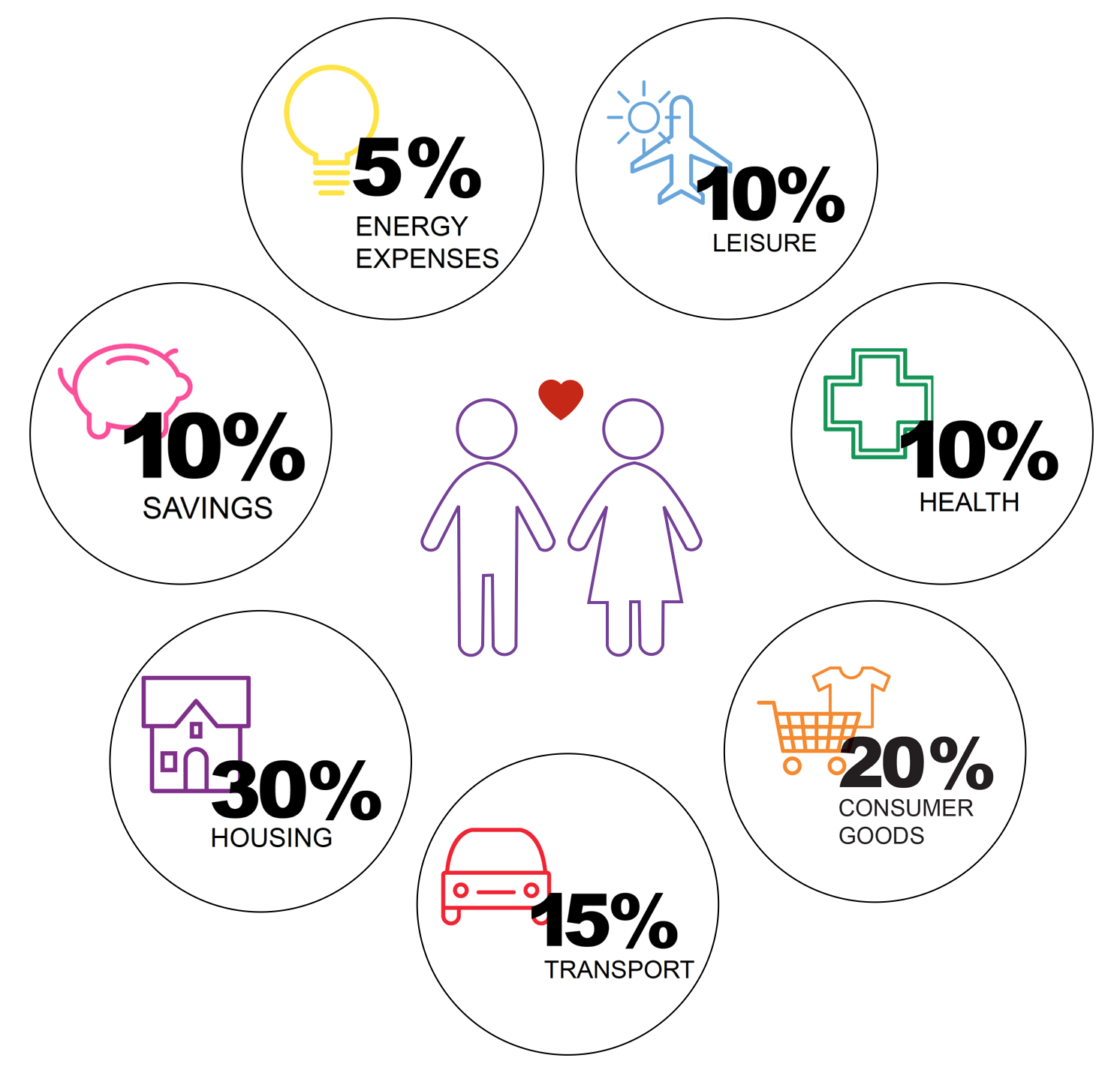

As a couple, the great novelty is that there’s often two sources of income. So, if certain expenses increase, so does the budget. Everything’s dandy! Nothing changes for housing: 30% is fine, in purchase credit or rent.

If new expenses pop up, we try to save money:

“Flowers on a balcony…are you sure? It’s going to impact our leisure budget!” (10%)

“Of course, flowers are lovely! Plus, we’re saving by paying energy bills as a couple.” (5%)

On the other hand, when a little bundle of joy with blond hair arrived, soon followed by a little brother, the “consumer goods” budget began to grow as well. One, two, three, then four mouths to feed and dress, you have to anticipate daily spending! At about 20%, this constitutes the second most important household expenditure.

“The little one has a toothache with the onset of fever…”

“Can we wait until we get back from our holidays, or do you know of a good dentist in Tokyo?”

For some healthcare costs, especially in the case of slight injuries abroad, taking additional health coverage isn’t a bad idea. (10%)

The couple makes yet another calculation:

“Did you put fuel in the car?” (15%)

“Check! Did you make a deposit into the savings account?” (10%)

“Check! We have a standing order for that, you know!”

And the loop was completed, the budget budgeted.

How do we make this budget? Equal or proportional to wages? And for “personal” purchases, like your golf permit? A full joint account or personal account, despite everything? For these questions, we’ll reply that there are two schools: those who… No, in fact there is none. In this regard, it’s up to you to figure out things based on your circumstances, income, desires and beliefs. For that, there aren’t any rules.

This article, for what it’s worth, merely exposes the main areas of expenditure. This simulation does not describe the absolute truth, but it presents percentages generally accepted as reasonable for determining the budget of a couple.

In conclusion? They say that money doesn’t buy happiness—but a well-managed budget should at least, in theory, contribute to it. Live happily!

Household budget at a glance

Mortgage

Mortgage Personal loan

Personal loan Savings

Savings