Compound interest: the time factor is key

Starting from a negligible amount and systematically reinvesting interest to in turn earn additional interest enables you to generate substantial sums. Compound interest is based on the principal of investing money and leaving it to work and itself generate money.

The legend of the grains of rice and the chess board illustrates what is at play behind the concept of compound interest. The brahmin Sissa, inventor of the Indian version of chess, presented this new game to his maharaja, who was so enchanted that he offered its creator a reward Asked what his reward should be, Sissa suggested grains of wheat for each square on the chess board: one grain for the first square, doubling to two grains for the second and doubling again for the third square and so on. Shihram laughed and agreed. He had no idea that he would have to find 18 trillion grains of wheat! Taking all the squares of a chess board together, this would be 2 to the power of 64 or 18.45 trillion grains of wheat, equal to 550 billion tonnes.

How does the principle work?

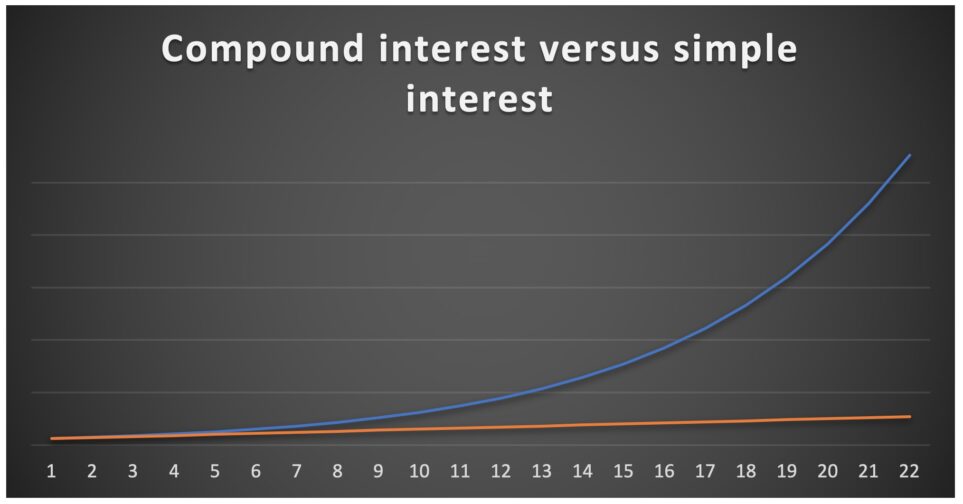

Savers invest and are paid a return on their investment. If they invest this return, this in turn generates more interest. This can all be illustrated by a diagram where the vertical axis is the amount invested and the horizontal axis is time: to start with there is a straight line, which gradually becomes a rising curve until eventually exponential growth kicks in. The time factor is key.

Compound interest depends on a personal investment decision. When you make an investment, either you can leave it to grow, or you can withdraw the returns. If possible, it’s better to leave the interest to generate additional interest. The earlier you start to save and invest, the more time the capital has to grow. To gain a rough estimate of the time required to double your capital in this way, you can divide the annual return by 72. So if you invest EUR 25,000 at an annual return of 4%, you will need around 18 years to double this to EUR 50,000. The lower the interest rate, the longer it will take. If your savings account only pays 0.5% per year, it would take around 144 years according to this formula to double your capital.

Patience is key

Savers must be able to afford to accumulate capital and to leave the invested amounts and interest to grow over several years. To take advantage of exponential capital growth and the related financial freedom in the future, you must not be dependent on the returns on your capital in the interim period. You therefore need another source of income to cover your living costs. But the fact is that even small monthly amounts can generate high returns over the long term.

Savers must be able to afford to leave interest to grow over several years.

Einstein allegedly said: “Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it.” As this is a symmetrical system, it applies to both assets and liabilities. Investors receive interest, which is reinvested to earn an additional return. For borrowers, it is recommended to pay back loans (such as consumer loans) as early as possible and only then to start saving. The snowball effect sought for assets (investments) should be avoided at all costs when it comes liabilities (debt), as it could result in over-indebtedness.

“Patience is the main ingredient to success. Investors must have a long-term horizon when it comes to stock markets and not deviate from their investment strategy. It’s important to stick to an investment plan and not be transfixed by the market environment”, says Olivier Goemans, Senior internal trainer at BIL. As he explains, the momentum of compound interest is based on three elements: capital, returns and time. “Anyone can contribute capital. I always remind people that, in principle, time works in their favour, providing returns are positive. Each passing day generates interest”, says Goemans. That just leaves the issue of returns. The price of financial assets can fluctuate indiscriminately over the short term. Over the long term, they are a better reflection of the economic situation. It is possible to estimate returns over the medium and long term, but there are no guarantees, just opportunities and assumptions.

The price of financial assets can fluctuate indiscriminately over the short term.

Is there a connection with the climate crisis?

Is there a connection between compound interest and the climate crisis? Carbon works like money: both have a present value and a future value. So it’s interesting to include your individual carbon footprint (estimated at 15 tonnes in Luxembourg) in your budget and adopt a compound-interest approach to this. “Each of us has a carbon footprint and a carbon budget (quantities of CO2 that we can emit through to the end of the century if we are to restrict the rise in temperature). We need to get started on this major undertaking right now. On this issue too, time works for or against us, depending on whether we are in credit or in debit, and you don’t need me to tell you that we are currently on the wrong side of this equation”, says Olivier Goemans.

Goemans emphasises that the role of the bank adviser regarding compound interest is often to act as a type of coach, objectively presenting the environment and preventing clients from falling prey to excessive emotion. For others, the role is primarily to find strong investment ideas and convictions. “It is part of our job to update ourselves systematically and continuously, and explain the risks and opportunities to clients in a fully transparent manner. On this basis, we select financial instruments that we believe are appropriate and fitting in light of our various scenarios. A bank adviser is a financial intermediary who helps clients to achieve their life goals, matching these goals to the reality of financial markets,” says Goemans. The relationship with the client is based on trust. “And well-placed trust works on the compound-interest principle, providing that you leave enough time for it to take effect.”

Mortgage

Mortgage Personal loan

Personal loan Savings

Savings