Home savings scheme: plan for tomorrow and benefit today

You’ve probably heard about home savings accounts and the tax advantages they offer. But do you know how they work and how they can benefit you? myLIFE explains how you can make the most of this long-term savings solution, while instantly benefiting from a tax reduction.

A home savings solution is a product that aims to save the subscriber money in order to obtain a loan to finance either the purchase of their primary residence or any building work required. The loan amount will be equivalent to the amount saved. As such, by saving, you can obtain a loan on preferential terms to purchase your future home or carry out building work.

Example: Mr X puts €100 into his home savings account every month for 10 years (standard term). He therefore saves €12,000 (plus interest). After 10 years, the savings and loan association offers him a loan equivalent to the amount he has saved. Mr X can either choose to reject the loan and recoup his savings to invest them in his primary residence, or accept the loan. In this case, he will have €12,000 that he has saved as well as a loan of €12,000 from the savings and loan association, i.e. €24,000 to carry out building work on his property.

The main advantage of a home savings account is that it is tax deductible.

Why are home savings accounts attractive?

Home savings schemes offer a number of advantages. The interest paid each year is tax exempt (subsidised interest in the Grand Duchy of Luxembourg) and the subscriber is guaranteed to obtain a loan at the end of a defined period, at a pre-determined interest rate.

But, the main advantage of a home savings account is that it is tax deductible. Contributions and premiums paid can be deducted from taxable income up to the ceilings defined by the legislator.

What are the deductibility conditions for payments?

All taxpayers, whether residents or cross-border workers, can benefit from tax deductions linked to home savings accounts. However, they must satisfy a number of conditions:

- file a tax return or annual statement in Luxembourg;

- be equivalent to a resident for tax purposes (in the case of cross-border workers);

- subscribe to a home savings scheme with a savings and loan association that is authorised in Luxembourg (BHW Bausparkasse or Wüstenrot Bausparkasse) or in another EU member state1;

- comply with the legal term of the scheme before using the funds;

- sign an agreement to finance the purchase, construction or renovation of a property used for the taxpayer’s personal housing needs.

Since the 2017 tax reform was implemented, to be eligible for tax benefits, the conditions of use for the savings have become very strict.

Bob Schmit, Senior Product Manager – Lending at BIL explains: “This last point is very important because since the 2017 tax reform was implemented, to be eligible for tax benefits, the conditions of use for the savings have become very strict. It is a condition that the money is used for the primary residence, whether to build a house, convert it, renovate it or repay a mortgage.”

Examples of legally compliant use: construction of a primary residence, repayment of a mortgage, façade restoration, roof repairs, re-wiring, plumbing work, financing of a bathroom or the purchase of new windows, a boiler, tiles or paint.

Examples of non-compliant use: financing of property other than the primary residence (apartment for rental purposes, farm or craft buildings, second home, etc.), purchase of movable property (sofa, tables, chairs, kitchen, etc.) or a car, etc. “Purchasing a kitchen is not permitted”, stated Mr Schmit. “Kitchens are considered movable property by the tax authorities rather than immovable property. That is something worth knowing!”

What happens if you fail to satisfy the conditions?

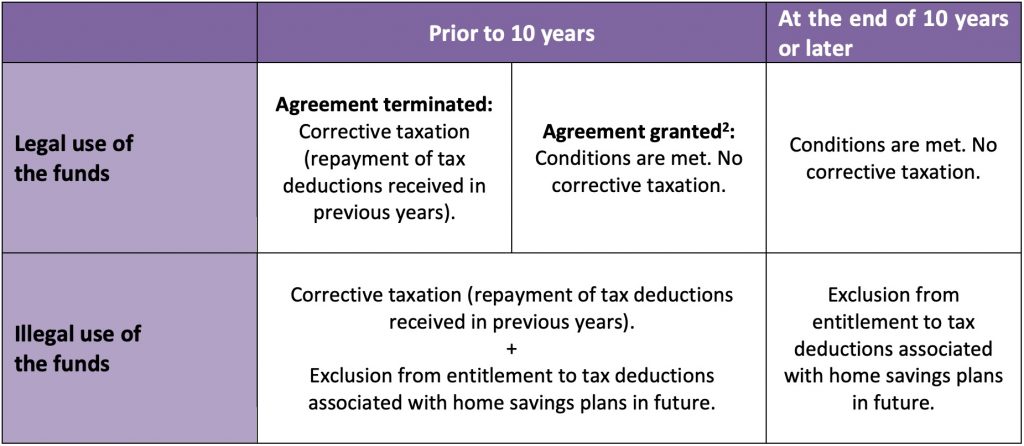

In most cases, home savings accounts are opened for a minimum term of 10 years. Any payments made during those 10 years are tax-deductible, provided that the funds are used as stipulated. If a taxpayer fails to satisfy these conditions, they may no longer be entitled to tax deductions and, in certain cases, will even be required to repay what they have received. As such, although there are no legal conditions regarding home savings scheme terms in order for the premium to be tax deductible, there will be a tax adjustment made for premiums previously deducted if an agreement is terminated early or if it has a term that is shorter than 10 years and the funds are used for non-compliant purposes.

To make this clearer, we have provided a table summarising what will happen if the conditions for deductibility are not satisfied.

“The home savings account belongs to the person identified in the agreement,” explains Bob Schmit. “Let’s take the example of a married couple, in which each partner opens a home savings account. The wife uses the money from the account to carry out building work on the property, while the husband buys a new car. In this case, the husband may still open a home savings account, but the payments made will not be deductible; they will be for his wife, however. If parents open a home savings account in their child’s name and use the funds in an unauthorised manner, the child will never again qualify for tax deductions linked to this type of account.”

What are the deductible amounts?

Each year, premiums and payments in respect of a home savings account are deductible:

- up to €1,3443 if the subscriber is between 18 and 40 at the beginning of the year;

- up to €672 if the subscriber is over 40.

This amount is increased by the number of people in the household: the spouse (or partner when they are taxed jointly) and each child for which the taxpayer receives a child tax allowance.

“A single person opening a home savings account exclusively to benefit from tax deductions must save at least €56 per month,” highlighted Schmit. “They may thus deduct the maximum amount at the end of the year, i.e. €672. If there are several people in the household, this is €672 per household member, unless an increase applies.”

Example no. 1: Household with three children

The mother (subscriber of the home savings scheme) is 43 and the father is 45. They will be able to deduct:

2 x €672 for the parents and 3 x €672 for the children = €3,360.

It is therefore in their interest to save at least €280 per month, as this can be deducted from their taxable amount.

Example no. 2: Household with two children

The mother (subscriber of the home savings scheme) is 38 and the father is 42. They will be able to deduct:

2 x €1,344 and 2 x €1,344 for the children = €5,376.

It is therefore in their interest to save at least €448 per month, as this can be deducted from their taxable amount.

For the increase in the tax-deductible threshold to be taken into account, one of the couple must be under 40 years of age (the subscriber). The tax-deductible limit is then doubled for all members of the household.

Useful info for Belgian and French cross-border workers

Mr Schmit also raises an important point; although resident and cross-border taxpayers can open a home savings account in Luxembourg and benefit from tax deductions, loans are only granted at maturity for property located in Luxembourg or in Germany.

“If, for example, you already live in your primary residence and you plan to have building work done on it in future, you are free to use the funds saved to work on your property once the home savings scheme reaches maturity, wherever the property is located.

However, if you are subscribing to a home savings scheme in order to finance the purchase of your main residence and you want to apply for the loan once the agreement reaches its term, the property must be located in either Luxembourg or Germany. As the parent companies of the savings and loan associations are located in Germany, they will not grant mortgages on houses or apartments located in Belgium or in France.”

How exactly do you obtain a tax deduction?

To deduct premiums and payments in respect of a home savings scheme, you must submit a Luxembourg tax return (form 100) (or an annual statement (form 163) ).

Considered as “Special expenses”, home savings scheme payments must be mentioned in section “E. Epargne-logement” on page 15 of the tax return.

Simply include the name of the savings and loan association, its identification number, the start date of the agreement and the amount of premiums paid over the year. A copy of the statement sent by the savings and loan association showing the amount of annual payments should be attached.

1 Payments made to loan, banking or financial organisations, such as in the case of a home savings scheme are not tax deductible!

2 Agreement granted: agreement for which the initial savings period has expired, i.e. the client may request the provision of a loan.

3 The 2017 tax reform increased the deductible threshold for subscribers under 41 years of age from €672 to €1,344.

Mortgage

Mortgage Personal loan

Personal loan Savings

Savings