What family benefits are available in Luxembourg?

Family allowance, birth allowance, back-to-school allowance, etc. What family benefits are available in Luxembourg? How can you obtain them and what are the conditions? myLIFE gives you the rundown.

Are you adding a child to your family? Are you a parent starting work in Luxembourg? Subject to certain conditions, you may be entitled to family benefits in Luxembourg to help you cover the cost of expenses related to your child or children.

These may be benefits in kind (such as childcare service vouchers, providing financial assistance for your children’s childcare costs and for some of their extracurricular activities) or cash payments: family allowance, back-to-school allowance, special supplementary allowance, birth premium and parental leave allowance.

Léa is pregnant with baby Hugo. She works and lives in Luxembourg with her husband. Taking her as an example, let’s review the main assistance to which she’s entitled for her child. Don’t forget, however, that government aid and allocation conditions are subject to change at any time by the legislator.

Birth premiums for mothers before and after the birth

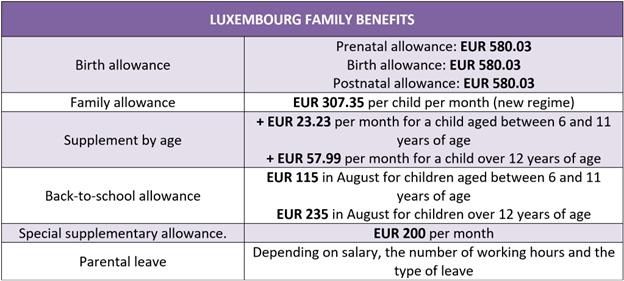

Firstly, subject to certain conditions, Léa can access birth premiums to prevent any health issues that may arise during her pregnancy or the birth, or which may affect her child. This allowance is paid upon request in three instalments of EUR 580.03 each.

-

- Prenatal allowance: to be eligible for this allowance, over the course of her pregnancy, Léa must undergo at least five medical examinations and one dental check-up.

- Birth allowance: in order to receive this allowance, the baby must be born alive and Léa must undergo a post-natal examination with a doctor specialised in gynecology and obstetrics.

- Postnatal allowance: Léa can claim this allowance provided that Hugo has six medical check-ups (with a paediatrician, an internal medicine specialist or a GP) before his second birthday.

For each instalment, Léa must provide the CAE (Caisse pour l’Avenir des Enfants) with an application form completed by the various doctors. Attention, she will not be able to benefit from these premiums if the prescribed examinations are carried out by a midwife.

Useful info: the first two instalments can only be paid to mothers resident in Luxembourg or members of the Luxembourg social security scheme. The final instalment can be allocated to one of the parents (mother or father) working in Luxembourg and registered with the Luxembourg Centre Commun de la Sécurité Sociale (CCSS) from the child’s birth until their second birthday, or for a child raised continuously in Luxembourg during the same period.

The family allowance amount is EUR 307.35 per child. It is paid monthly from the arrival of the first child.

Family allowance for children from birth to 18

As a resident of Luxembourg, Léa is entitled to the family allowance from the CAE provided that Hugo is legally resident in Luxembourg and that he continuously and actually lives there.

The allowance is granted from the child’s month of birth until their 18th birthday. Subject to certain conditions, this may be extended to 25 years of age for young people in secondary education, specialised education or an apprenticeship, etc.

The family allowance amount is EUR 307.35 per child. It is paid monthly from the arrival of the first child. This monthly amount is increased for older children:

-

- EUR 23.23 extra for children over six years of age;

- EUR 57.99 for children over 12 years of age.

As such, until Hugo turns six, Léa will receive EUR 307.35 each month, and then EUR 330.58 (EUR 307.35 + EUR 23.23) until his 12th birthday. Then, she will receive EUR 365.34 (EUR 307.35 + EUR 57.99) each month until his 18th birthday, or until his 25th birthday at the latest if he pursues further education. These amounts are likely to change in future as family allowance is indexed to the cost of living.

| Two allowance systems operating in parallel

The family benefits system was reformed in 2016. Prior to that date, the allowance amount varied depending on the number of children in the household. Today, the allowance is the same for each child, regardless of the number of children in the household. The two systems now work together:

NB: in the event that entitlement to the family allowance is suspended and then resumed, the new provisions will apply automatically. |

To receive the family allowance, Léa must submit an application form to the CAE along with a copy of her son’s birth certificate and her bank account details slip (RIB) The supporting documents required vary depending on the place of residence and nationality. These are indicated on the family allowance application form.

Back-to-school allowance for children between six and 18 years of age

To help with back-to-school expenses, Léa may receive the back-to-school allowance for her son. It is paid automatically for all children over six years of age in receipt of the family allowance and enrolled in basic education.

The back-to-school allowance is paid automatically for all children over six years of age in receipt of the family allowance and enrolled in basic education.

The back-to-school allowance is paid in August and amounts to:

-

- EUR 115 for children aged between six and 11 years of age;

- EUR 235 for children over 12 years of age.

For example: If Hugo’s sixth birthday is in June, Léa will automatically receive the back-to-school allowance in August, without needing to do anything. However, if her son’s birthday is in October, and he hasn’t turned six when he goes into his second year of primary school, Léa will need to submit a school certificate to receive the allowance.

The payment of the back-to-school allowance will end the year in which secondary or equivalent education is completed.

Supplementary allowance for children with a disability

Children with disabilities may, subject to certain conditions, be entitled to a supplementary allowance to cover any additional costs related to their circumstances. This allowance is paid monthly to children in receipt of family allowance and amounts to EUR 200.

To obtain it, the child must suffer from a condition resulting in a permanent deficiency or loss of at least 50% of their physical or mental capacity in comparison with a child without disability of the same age. The application form and the medical form to be completed by a doctor must be requested in writing from the CAE: Special supplementary allowance application.

| Are cross-border workers eligible for family benefits in Luxembourg?

Cross-border workers in Luxembourg and compulsorily registered with the Luxembourg Centre Commun de la Sécurité Sociale (CCSS) can claim Luxembourg family allowance for their biological or adopted children, but also for the children of his or her spouse or partner for whom he or she provides support*. The application must be made in the country of residence and in the country of employment. Depending on the circumstances, benefits are paid subject to rules of priority.

In the latter case, when the amount granted by the country of residence is less than that which would have been paid by the Grand Duchy, Luxembourg makes a half-yearly payment to make up the difference: this is called the differential supplement. It can be granted for the family allowance, the back-to-school allowance and the special supplementary allowance. No differential supplement is paid for the birth allowance, however. * The conditions for granting family allowance for the children of a spouse or partner are set out in Article 270 of the Social Security Code, amended following the judgment of the Court of Justice of the European Union of 2 April 2020. |

Parental leave allowance

Following the birth of their son, Léa and her husband may, subject to certain conditions, take parental leave. This will allow them to reconcile their family and professional lives by reducing or suspending their working hours. They will receive replacement income paid by the CAE, the amount of which varies depending on their wages, the number of hours worked each week and the type of leave taken.

The parental leave is granted once per parent per child. The first leave must be taken immediately after the maternity or adoption leave by one of the parents (except for the parent who is raising their child alone or is the only one to benefit from parental leave – if the other parent is not working, for example). The second parental leave must be taken by the other parent before the child’s sixth birthday (12th birthday in the case of adoption).

Good to know: both parents can request their parental leave simultaneously.

Since 2016, subject to certain conditions, parents have been able to choose the type of parental leave.

For people working 40 hours a week:

-

- Full-time leave (4 or 6 months);

- Part-time leave (8 or 12 months);

- 1 day a week (maximum period of 20 months);

- Or 4 months (maximum period of 20 months).

For those working 20 hours or more per week:

-

- Full-time for 4 or 6 months;

- Or part-time for 8 or 12 months.

For parents working 10 hours or more per week, or those in an apprenticeship contract:

-

- Full-time for 4 or 6 months.

Attention: if the parent has multiple employers, they will only be able to choose full-time parental leave for 4 or 6 months.

To obtain this, Léa and her husband must submit their application by registered letter to their employers, at least two months before the start of the maternity leave for the first parental leave, and at least four months before the start of the second parental leave. More information on the article: Parental leave: who, what, how, how much?

Summary

Mortgage

Mortgage Personal loan

Personal loan Savings

Savings