Compound interest: the key to exponential growth

Although we often think in a linear fashion, the world around us is much more complex. Compound interest that works exponentially to grow your capital is the perfect example of this. Olivier Goemans, Senior Portfolio Manager at BIL explains how this type of interest works and offers some advice on how to take advantage of its benefits.

What do we mean by compound interest?

The legend of the origins of the game of chess gives us a good understanding of what is at play behind the idea of compound interest. According to legend, the brahmin Sissa, inventor of the Indian version of chess, presented the game to his maharaja who was so enchanted that he offered Sissa a reward. Asked what that reward should be, Sissa suggested rice: one grain of rice placed on the first square of the chess board, doubling to two grains on the second square, four grains on the third, eight grains on the fourth, and so on until the 64th square. The maharaja thought this request too modest but agreed to it. However, when he came to honour his promise, the maharaja quickly realised that there was not enough rice in his entire kingdom. By doubling up the grain of rice in each square, the 64th square alone would require 263 grains of rice, or a 20-digit number equivalent to 550 billion tonnes of rice (more than 1,000 years of global production).

By starting with a small quantity, it is possible to reach substantial amounts, providing that interest is capitalised so that it can, in turn, generate additional interest.

In other words, by starting with an infinitesimal quantity, it is possible to reach substantial amounts, providing that interest is systematically capitalised so that it can, in turn, produce additional interest. We are used to working on a linear basis. Reasoning on a geometrical or exponential basis is therefore more complicated. The underlying idea with compound interest is to invest money and then leave this money to “work” to produce more money.

How does compound interest work?

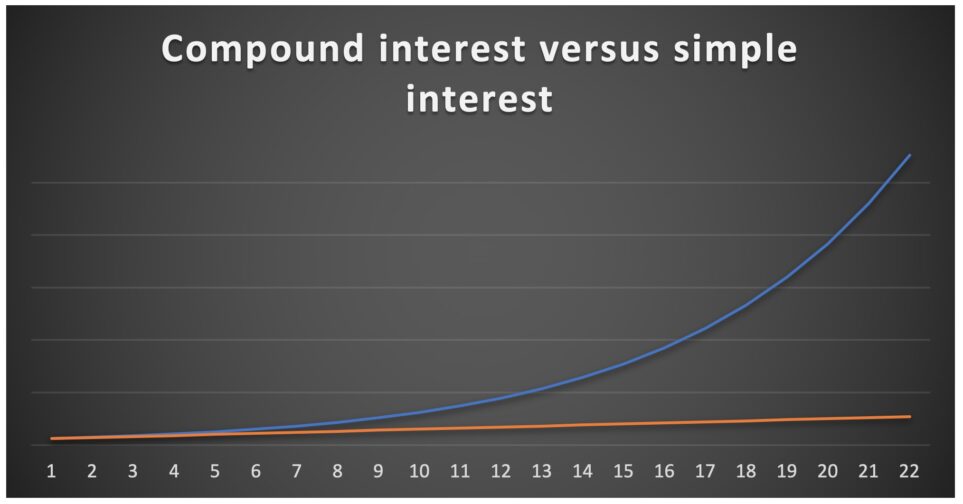

As a saver, you are paid a rate of interest, a return, on your investment. If you invest this return, it will in turn generate more interest. If we draw a chart where the vertical axis shows the amount invested and the horizontal axis shows time, we will start with a sloping line which will gradually turn into a rising curve before tipping into an exponential relationship.

Compound interest will therefore depend on a personal decision regarding your investments. When you make an investment, either you can leave it to grow, or you can withdraw the returns. If you have the choice, it’s better to leave the interest to generate additional interest. The earlier you start to save and invest, the longer your capital will have to grow. To gain a rough estimate of the time required to double your capital in this way, you can divide the annual return by 72. So if you invest EUR 25,000 at an annual return of 4%, you will need around 18 years to double this to EUR 50,000. The lower the interest, the longer the duration. For example, if your savings account only pays 0.5% per year, it would take around 144 years according to this formula to double your capital. If this seems too long, investing may be the solution for you.

Are there any restrictions to consider?

All investments should be made on a medium/long-term horizon. Given the above formula, this is particularly true when annual returns are modest. Savers must be in a position to capitalise interest and leave the invested amounts plus the interest to grow over several years. If you need the returns on your investment to live on, you will not be able to wait and take advantage of the exponential growth in capital and the resulting financial security. This implies that you need another source of income that is enough to live on.

Does this system work the same way for investors and borrowers?

Apparently, Einstein once said, “Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it.” This system is symmetrical and therefore works for both assets and liabilities. For investors it means that interest earned can be reinvested to earn an additional return. Borrowers are best advised to repay any debts (such as consumer credits) as early as possible, before starting to save. The snowball effect that we look for with assets (investments) should be avoided when it comes to liabilities (debts) or it can lead to over-indebtedness if we are not careful. Like the super-rich maharaja who was unable to honour a debt which seemed benign at first sight. In some cases, borrowers will take out a second loan to repay the capital and interest on a loan that was taken out to cover ordinary expenditure. This sets up a vicious circle based on the principle of compound interest.

How can you take advantage of this snowball effect with investments?

Patience is required – it is the main ingredient to success. Investors must have a long-term horizon when it comes to stock markets and not deviate from their investment course. It’s also important to stick to an investment plan and not be transfixed by the market environment.

The momentum of compound interest is based on three elements: capital, returns and time.

The momentum of compound interest is based on three elements: capital, returns and time. Capital refers to whatever you can invest. I then remind people that time always works in their favour, providing that returns are positive. Each passing day generates interest. That just leaves the issue of returns. The price of financial assets can fluctuate indiscriminately over the short term. Over the long term, prices are a better reflection of the economic situation. It is possible to estimate returns over the medium and long term, but there are no guarantees and you need to make a good few approximations and assumptions. My role is therefore to imagine scenarios and humbly assess the likelihood that they will actually occur.

Is there a connection between interest and the climate crisis?

Carbon works like money, it has a present value and a future value. So it’s interesting to include your individual carbon footprint in your budget (estimated at 15 tonnes in Luxembourg) and adopt a compound-interest approach to this. Each of us has a carbon footprint and a carbon budget (quantities of CO2 that we can emit through to the end of the century if we are to restrict the rise in temperature). We need to start on this major undertaking today. On this issue too, time works for or against us, depending on whether we are in credit or in debit, and you don’t need me to tell you that we are currently on the wrong side of this equation.

What role does a bank adviser play in this context?

Everything depends on the type of client. First of all, we always take the time to talk to clients in order to understand their needs and objectives. As a portfolio adviser or manager, MiFID requires us to properly understand our clients’ expectations, investment horizon and risk aversion.

For some clients we act as a coach, detailing the environment and helping them to avoid falling prey to excessive emotion. For others, our role is primarily to find strong investment ideas. Our job obliges us to be systematically up-to-date and to get to grips with the risks and opportunities with the client in a fully transparent way. On this basis, we select financial instruments that we believe are appropriate and fitting in light of our various scenarios.

A banker is a financial intermediary who helps clients to achieve their life goals, matching these goals to the reality of financial markets. Your relationship with your banker is based on trust. And well-placed trust works on the compound-interest principle, providing that you leave enough time for it to take effect.

Mortgage

Mortgage Personal loan

Personal loan Savings

Savings