Education as an investment theme

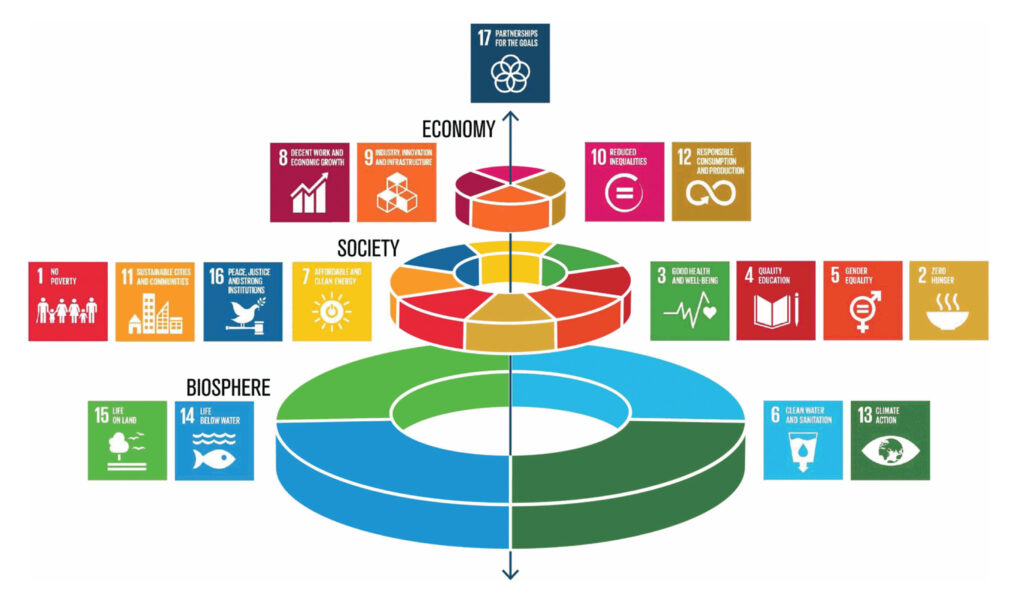

The number of investors seeking out a double bottom line of profit and purpose in their investment decisions is growing. When it comes to having an impact, investors have an array of choice as to the kind of impact they would like to make. A good place to start is with the UN’s 17 interconnected Sustainable Development Goals (SDG). These goals form the core of the UN’s 2030 Agenda for Sustainable Development, a ‘blueprint to achieve a better and more sustainable future for all’.

The UN’s SDG “Wedding Cake”

Source: UN

In this piece we will focus on the fourth goal which is centered around the provision of “quality education” for all. From our perspective, education is a human right, is vital to society and an essential ingredient for inclusive and sustainable growth. For this reason, its development lies at the core of most government policies. Take for example, President Biden’s American Families Plan: Education is a key tenet of the $1.8 trillion proposal which aims to grow the middle-class and expand the benefits of economic growth to all Americans1.

The SDGs dovetail with one another and education is one of the most wide-reaching and beneficial development investments. It delivers the opportunity to acquire essential work and life skills, lifts people out of poverty, and contributes to empowerment and health. The Brookings Institution calls secondary schooling for girls the most cost-effective and best investment against climate change2.

A Blended Learning Environment

Traditionally, universal education was perceived as a public good that should be provided by nation states, but stretched budgets and a lack of capacity to meet the growing need for education means that demand is underserved in many countries. This has been exacerbated by the global health crisis. The 2020s were supposed to mark a “decade of delivery” for education but instead, it seems as if the clock is being turned backwards. Two-thirds of low and lower middle-income countries have cut education spending and the global education funding gap could soon rise to $200bn a year3. On top of this, entrenched interests unique to the public education sector make innovation and broad-brushed changes to the existing system difficult to enact.

This presents an opportunity for private capital to become more active in the sector, bringing innovation and digitalisation. Already, Covid-19 has served as an accelerator by creating the largest disruption of education systems in history as classrooms and lecture halls were pushed into the digital realm. From here, we envisage the emergence of a “blended learning environment” whereby information and communication technologies complement traditional education methods to satisfy growing needs and changing demands.

Mega-Trends

As an investment theme, education coincides with various “mega-trends” that will continue to reshape the global landscape over the longer term including…

In the future, online learning could well mean that even the most remote communities can access quality education.

Digitalisation – In April 2020, almost 200 countries had announced school or university closures, affecting roughly 1.6 billion students. The sudden need to shift activity online was disruptive, lengthy and painful for most of the concerned students, but it has accelerated the adoption of new, innovative methods to deliver learning, creating new growth drivers within the sector. In the future, online learning could well mean that even the most remote communities can access quality education.

We believe that once the pandemic subsides, technology will play a bigger adjunct role in education and the growth potential is substantial. The “edtech” sector is already flourishing. US start-ups in this space raised a record $1.7 billion in 2019, only to surpass that record again in 2020, with $2.2 billion4. But this is a drop in the ocean on the international stage. Education market research firm HolonIQ tallied over $16 billion of venture capital raised by education companies globally in 2020, with China and India accounting for over 77% of that total.

With regard to non-conventional education, online platforms were promulgating before the pandemic. Language learning apps such as Babbel and Duolingo were considered legitimate tools for learning a language (according to an independent study conducted by the City University of New York and the University of South Carolina, 34 hours of Duolingo are equivalent to a full university semester of language education). At the same time, so-called MOOC platforms (“massively open online courses”) such as Coursera or edX , were democratizing education, making entire courses from renowned institutions such as Harvard and Yale, available to everyone, for free (or for a modest price to be eligible for certification). These platforms leverage data from millions of learners, using machine learning to automatically grade assignments and deliver adaptive content and assessments. The growing cost of higher education makes online alternatives an attractive option. Just as an example, in the US, students can pay roughly $38,000 per year for fees and accommodation at a public university and around $50,000 per year at a private university5.

As such, we believe that online tools will continue to proliferate, driving growth in the sector in fields such as virtual and/or augmented reality, 3D printing and artificial-intelligence-enabled robot teachers. In developing countries, private companies are stepping in to provide children access to affordable computers to access online learning. A good example is WAWA Laptop, the first laptop developed in Peru, made from recycled material and powered by a portable solar panel and aimed at democratizing access to technology and education for children. Globally, there is still a lot of work to be done in this area.

The ever-beating drum of technological change means there is a growing need for education to ensure that existing skillsets are not rendered obsolete.

Lifelong learning – Life-long learning is emerging as a theme thanks to the growth in retired populations as well as the need for workers to update knowledge throughout their careers. The pandemic has ushered in the fourth industrial revolution quicker than expected and the ever-beating drum of technological change means there is a growing need for education to ensure that existing skillsets are not rendered obsolete. We expect a shift away from one-and-done degrees, towards lifelong learning. According to the World Economic Forum’s 2020 Jobs Report, for those workers set to remain in their roles, the share of core skills that will change in the next five years is 40%, and 50% of all employees will need reskilling.

Companies are recognizing that training is more important than ever and that employees need to be given the opportunity to “upskill”.

Societal changes – As it stands, 11% of the global population has no prior education. This is expected to decrease to 5% by 2050. As wealth increases in developing nations, the growing middle class is seeking education, recognising that it is a sure way to improve future prospects. Indeed, in China, one of the world’s fastest growing economies, education has been the category that received the largest proportion of government spending since 2010. ATAWAD education “Any time anywhere, any device“ broadens the potential target market, widening access, especially in rural areas.

In developed nations, there is also a desire for a higher education in order to enjoy better career prospects and a higher-standard of living. Many are in pursuit of a multi-faceted CV that improves their employability, sometimes through the traditional education route, sometimes through industry certifications. Growing and evolving demand entails innovation and it is recognised that educational programs and methods need to be changed, also to support professional development.

Millennials, in particular, are pushing up demand for education. While by old metrics, they may seem “poor“ (having shunned traditional status symbols likes houses, cars and possessions), they are in fact, hedging themselves for the future by making smart investments in education, which will help them succeed in the “new economy“.

Implications for investors

The aforementioned trends show no sign of abating, and education will remain an important theme for as long as they are at play.

Demand for education is set to grow, whether it be from developing economies with expanding middle classes or from developed countries whereby people wish to upskill and broaden their horizons.

Demand for education is set to grow, whether it be from developing economies with expanding middle classes or from developed countries whereby people wish to upskill and broaden their horizons. There is a multitude of technologies and innovations still to be exploited in this field, further expanding access and utility for the masses. Within the broad ecosystem of education, there is an array of companies, from those that focus on educational content and tools, to those that focus on publishing (books, professional magazines, educational media…), to those developing edtech (software and hardware), to those providing data security, to those providing educational facilities. The opportunities are vast.

Last, but certainly not least, the deployment of private capital into this thematic also yields wider societal benefits. While education is explicitly one of the UN’s 17 Sustainable Development Goals, it is also instrumental in achieving some of the others goals. The world around, the pandemic has highlighted a great social divide that needs to be addressed if we are to achieve sustainable and inclusive growth. We can extrapolate Joe Biden’s recent assertion that “investing in education is a down payment on the future of America” to say that if we invest on a global level in promoting education, it is a down payment on the future of our world.

Indeed, the economic benefits could be significant. It is estimated that ensuring every girl can learn for 12 years could unlock up to $30tn in global economic growth: Every country would benefit6. In an industry undergoing deep-set structural changes, new opportunities present themselves to investors. Education is a very broad thematic and there are multiple channels for investors seeking to invest in the topic.

It is estimated that ensuring every girl can learn for 12 years could unlock up to $30tn in global economic growth.

1 https://www.whitehouse.gov/briefing-room/statements-releases/2021/04/28/fact-sheet-the-american-families-plan/

2 https://www.brookings.edu/opinions/want-to-save-the-planet-invest-in-girls-education/

3 https://en.unesco.org/news/unesco-warns-funding-gap-reach-sdg4-poorer-countries-risks-increasing-us-200-billion-annually

4 https://www.edsurge.com/news/2021-01-13-a-record-year-amid-a-pandemic-us-edtech-raises-2-2-billion-in-2020

5 https://www.topuniversities.com/student-info/student-finance/how-much-does-it-cost-study-us

6 https://www.ft.com/content/d0948e4b-4dc6-4cdc-b357-28690d1edcbb

Mortgage

Mortgage Personal loan

Personal loan Savings

Savings