Going global with your SME

SMEs know all too well that the process of becoming an international exporter can prove to be so costly, it constitutes a major risk to companies. In addition to requiring substantial investments for foreign market research, managing logistics abroad and adapting products to the target market, the import-export business gobbles up liquidity and makes secure financial backing a necessity. But how can you obtain it?

When faced with a lack of financing, your first instinct might be to make an appointment with your banker. But international expansion means high investment and operating costs in exchange for a less-than-prompt return. And for your banker, this may be a risk that’s hard to take – unless they also have certain guarantees to mitigate it.

One thing you can do is present your business plan with preliminary figures, and perhaps even a portfolio of orders representing future revenues. As this will be a different market, your banker will want to see that you understand your future clients abroad: do you know their payment habits and their actual solvency? Does the target country offer a stable economy and political environment? Here, too, access to particular guarantees will work in your favour.

It’s a lot of uncertainty to manage, but don’t worry! You can rely on a competent, experienced intermediary with your best interests in mind, one that will help you begin your new journey on a brave foot. And it already has a framework agreement with a major Luxembourg bank.

ODL

Companies in Luxembourg can turn to the Office du Ducroire (ODL) to help them rise to the challenge of international expansion. Created in 1961, ODL is a public institution that positions itself as your gateway to the export business. It can assist your company in its activities abroad, including by providing financial support for international promotion and your presence at trade fairs, and by helping offset the risks of international transactions and investment.

On 13 May 2019, Banque Internationale à Luxembourg (BIL) announced the signature of a framework agreement aimed at increasing issuance of loans to finance international trade by Luxembourg companies. It was the first deal of its kind agreed between ODL and a bank, but others could follow. This type of agreement may be good news for your company, too, because they grow the bank’s capacity to help you realise your objective of exporting your goods and services. How, you ask? Through bank loan insurance, export insurance and insurance of guarantee commitments. ODL offers a broad range of resources, but we will focus on these three insurance products, which will make up the backbone of successful financing for your international expansion.

These agreements serve to facilitate companies’ access to funding during the operating cycle for import-export projects […].

Insurance of bank loans

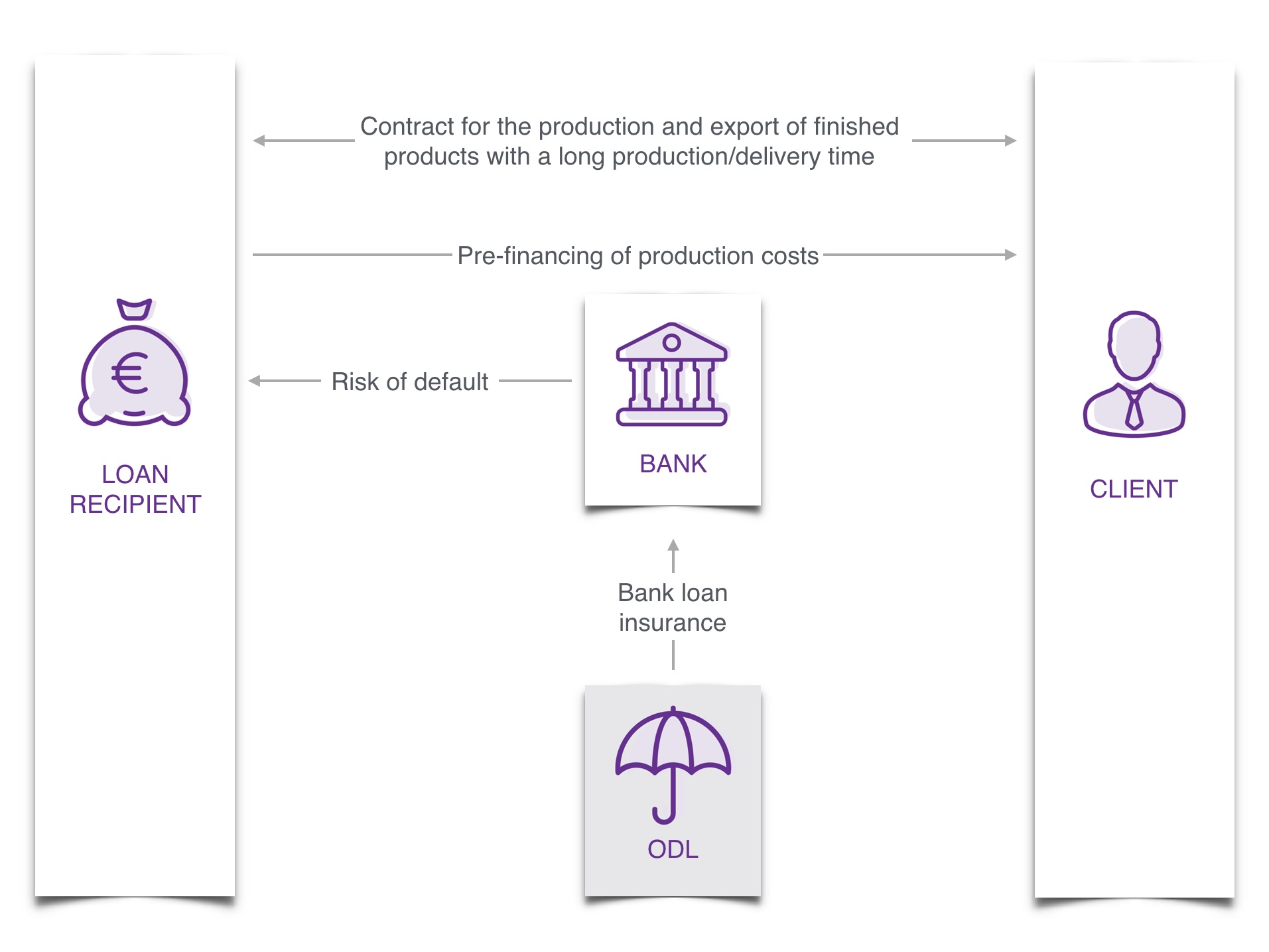

Your financial needs will be significant regardless of whether you’re importing or exporting, and with long production and delivery periods, it could take time to see a return on investment. This is a problem that you are likely already familiar with, and the agreements ODL can make with banks are one solution to it. They serve to facilitate companies’ access to funding during the operating cycle for import-export projects through a framework policy covering up to a certain portion of the default risk for the loans taken out. The agreement with BIL sets this threshold at 50%.

But in all its forms, bank loan insurance provides considerable leverage for the funding a bank can grant to Luxembourg companies by insuring part of the risk borne by that bank. This chart shows the relationship between actors within a bank loan insurance scenario:

Insurance of guarantee commitments

When it comes to international development, it is often useful (or even obligatory) for the exporter to issue guarantees, such as a guarantee of advance payment or performance of contract.

The special agreements that ODL is able to forge with your bank allow the latter to issue these guarantees on behalf of your company in the context of the export transaction.

ODL enables your bank to grant more guarantees by covering part of the default risk.

Thus, as an exporter, you enter into a contract with your foreign client and instruct your bank to issue the guarantee. And in insuring part of the risk of default, ODL permits banks to grant more bank guarantees to Luxembourg companies like yours. Should you, the exporter, default on payment, ODL will compensate your bank for the amount due.

Insurance of exports

This type of credit insurance gives your company some protection against losses resulting from default on payment.

ODL is able to help offset:

- debtor-specific risks (e.g. default or insolvency)

- external constraints (e.g. political and similar risks such as transfer risks or currency shortages, wars, revolutions, natural disasters and acts of State).

This credit insurance service provides three types of benefit:

- information on the creditworthiness of your clients and prospects to help you expand business relations with solvent counterparties

- collection of unpaid debts through local intermediaries

- compensation for secured claims in the event of default on the part of your client.

If necessary, your bank can act as beneficiary of an insurance policy issued by ODL.

In addition to its insurance products, only a few of which have been reviewed here, ODL offers a range of financial assistance for your international market research and prospecting. Visit the ODL website for more information, or talk to your banker. The myLIFE team wishes you the best of luck and success throughout your international expansion.

Mortgage

Mortgage Personal loan

Personal loan Savings

Savings