Have you considered using a safe to protect your property?

Would you like to keep a valuable object safe or protect important documents? myLIFE discusses the pros and cons of safe deposit boxes, whether at home, at a bank or even online.

We have all come to view safe deposit boxes as being the reserve of wealthy individuals, hidden behind paintings in stately homes or secured in bank vaults. The reality is quite different, however. Alongside jewellery, luxury watches, property deeds and bars of gold bullion, safe deposit boxes can also be used to store letters, administrative documents, photographs and items of sentimental value. And you don’t need to be made of money to use them.

For people wishing to store their prized possessions and important documents safely, in this article myLIFE takes a look at the different types of safe deposit boxes and their pros and cons.

Scenario 1: installing a safe at home

A practical solution…

Installing a safe at home might first sound appealing. It would allow you to keep valuable items safe from prying eyes and would-be burglars and may sometimes protect them from fire or other natural damage, giving you greater peace of mind.

Home safes can be accessed around-the-clock, making them a good option for storing items and documents you use regularly.

You can use them to store all the items you want in complete confidentiality. They can be accessed around-the-clock, making them a good option for storing items and documents you use regularly. Furthermore, only the person with the key or the combination is able to open them. You are also free to share your key or combination with anyone you choose, without having to follow any particular procedures. That might sound trivial, but it could prove important if you urgently need someone you trust to retrieve something from it.

… but expensive

Nevertheless, real security comes at a cost. Although the price of a safe will depend on its size, its effectiveness and features will also have an impact on cost. You should therefore decide in advance what size you require (20 litres, 30 litres, etc.), your preferred level of security and where you want to install it.

Please note:

- The security level of a safe is determined by its resistance grade. Lab tests measure how resistant it is to a break-in, fire or being dropped, etc. Security standards and levels are determined based on a variety of features: resistance to break-ins and fire, the strength of the lock, etc.

- The choice of where to install it is just as important: will it be placed on a shelf, built-in or bolted to the ground or to a wall? Think twice before opting for a safe that can be easily transported outside the home by the wrong people! There is no point having a near-impenetrable safe if criminals have all the time in the world to get into it. In short, proper arrangements should be made or indeed building work carried out to install it.

Finally, safes must be covered by specific insurance. In most cases, home insurance does not give enough cover for their contents. You must therefore think about taking out dedicated cover in addition to purchasing the equipment. Speak with your insurer to obtain an estimate of the value of the assets stored and bear in mind that additional security devices (cameras, alarms, etc.) are often recommended.

Scenario 2: renting a bank safe deposit box

Security is paramount…

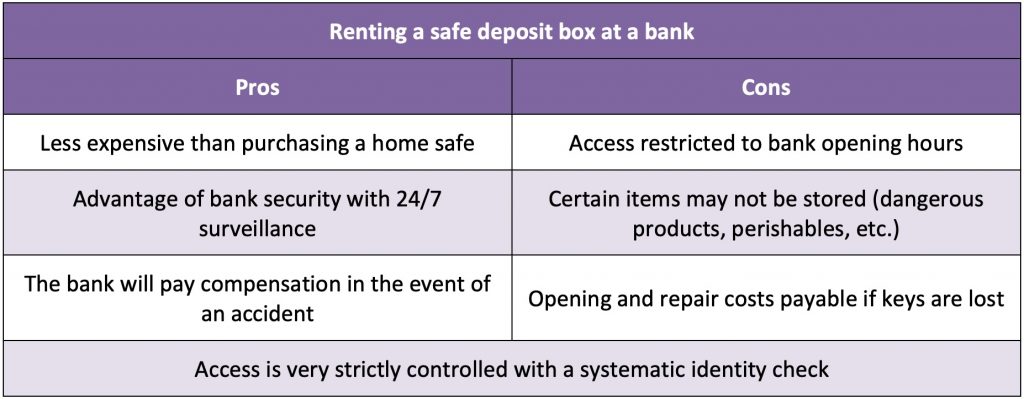

Would you like to maximise the level of security? Renting a safe deposit box at a bank is another option for protecting your assets. Many banks offer them to their clients, regardless of their income.

The advantage is that rental is cheaper than buying an individual safe and the cost varies depending on the size of safe. Annual rents are generally under EUR 100 for safe deposit boxes with a smaller capacity (<200 cm3). They are guaranteed to be secure, as banks operate 24/7 surveillance. Property is also covered, in principle, against fire and water damage.

Safe deposit boxes can be rented on an individual (exclusive access by the renter) or joint basis (both joint renters must be present to open the safe) or with joint access given to several people (free access to all joint renters). They are generally rented for renewable one-year periods, but some banks do allow shorter rental periods (holidays, extended business trips, hospitalisation, etc.).

… with a few constraints in return

Having such highly secure access to safe deposit boxes entails a number of obligations on the part of the renter. They can only access them during bank opening hours and identity checks are run systematically. Renters are required to draw up a power of attorney if they want to authorise a third party to have access.

Dangerous, illegal or perishable items cannot be stored in safe deposit boxes. Finally, if the renter loses their key, the safe will need to be opened by force, for which they will be sent the bill.

Scenario 3: Digital safe deposit boxes

What are they used for?

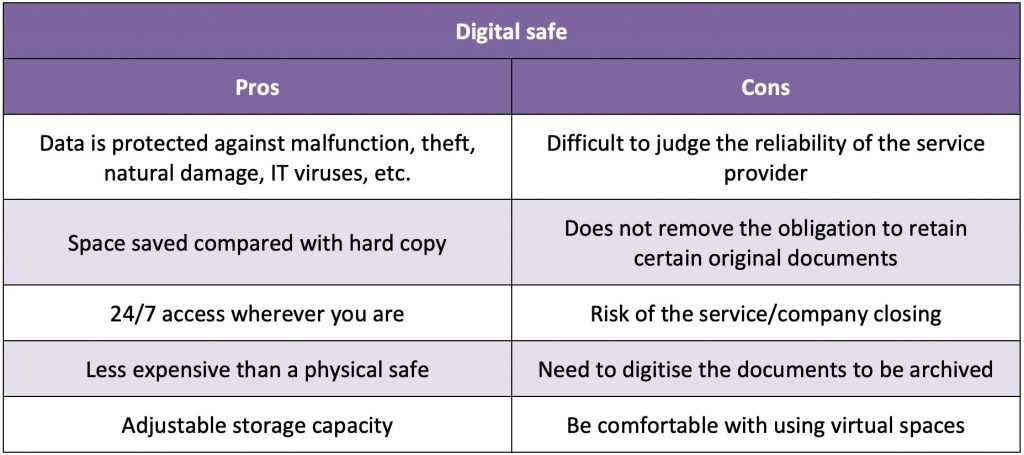

In the digital age, electronic documents also need to be protected. In the same way that precious items can be placed in a physical safe, sensitive or private digital files can be stored in a digital safe. Also known as electronic or virtual safe deposit boxes, they are highly secure storage areas allowing digital files to be archived and organised (administrative documents, copies of identity documents, contracts, payslips, tax assessments, bills, certificates, etc.).

The level of security, confidentiality and data protection is fundamental for a virtual safe.

The level of security, confidentiality and data protection is fundamental for a virtual safe. Access is only cleared after authentication. The data is encrypted and stored on dedicated servers offering a high level of security. This is what differentiates them from traditional digital archiving, which is only used to store documents. Saving a file to a hard disk or a USB stick does not mean it is secure. Such media are not protected against malfunctions, theft or viruses.

Electronic safe deposit boxes, which are already offered by several companies in Luxembourg, provide different features and levels of security. Some offer shared storage areas (accessible to the whole family, for example), while others allow administrative documents to be gathered and stored automatically. Owners can adjust the options to suit their needs. Be sure to check that storage is offered on an indefinite basis and is not limited to a few years, as may be the case for documents placed in your personal online banking area.

Some digital safe deposit boxes offer storage with evidential value, meaning that documents are time-stamped when they are placed in the safe (exact time and date) and each action is recorded (changes, consultation, etc.).

To conclude, which safe you choose will depend on three factors:

- Your budget;

- The type of items or documents that you wish to store;

- What you want to protect your assets against (thieves, onlookers, risk of theft, water damage, etc.).

Now that you know what options are available, it is up to you to decide which one best suits your needs… or go for all three!

Mortgage

Mortgage Personal loan

Personal loan Savings

Savings