How do the self-employed claim a pension?

We know that employees automatically pay a monthly contribution into a pension fund, but what happens to the self-employed? How do the self-employed claim a pension? What steps are should be taken and how do contributions function when you work for yourself? How can gaps between recent income and the statutory pension be anticipated and minimised? This guide has been compiled to help set entrepreneurs on the right track.

Definitions!

Although we all have an innate idea of what this concept means, let’s start by defining what is actually meant by the term “self-employed”. A self-employed person is someone who works for him or herself. This definition groups together three main categories:

-

- trades (e.g. baker or hairdresser);

- commercial (e.g. restaurateur, freight carrier, café owner, dealer);

- liberal professions (e.g. lawyer, doctor, architect or parental assistant).

Social contributions and reporting procedures

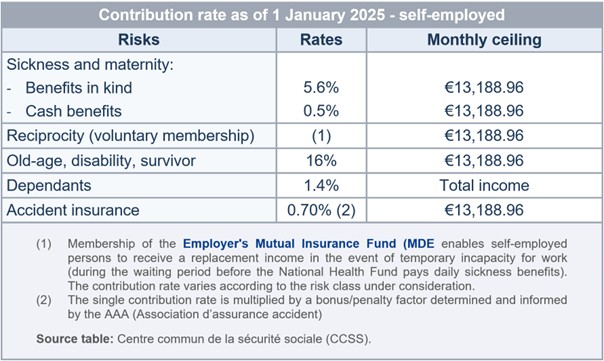

Upon commencing their professional activity, self-employed persons must join the Joint Social Security Centre (Centre commun de la sécurité sociale, CCSS) to be able to claim social security benefits. The calculation of social security contributions is based on the insured party’s income according to the tax declaration filed with the Direct Taxation Authority (Administration des contributions directes).

“Contributions are calculated on the basis of the self-employed person’s most recent income, or based on the minimum contributory amount for newly insured persons. The contribution base cannot be less than the monthly minimum social wage of €2,703.74 according to the CCSS.

NB: Upon ceasing or selling your activity, a number of administrative procedures must be put in place to validate the disaffiliation process or indeed overturn certain authorisations.

Administrative procedures to consider:

-

- authorisation of the establishment;

- social security;

- VAT;

- commercial registry;

- direct taxes, etc.

The general pension insurance scheme

Like employees, all self-employed workers are included in the general pension insurance scheme. The legal age to begin claiming a pension is 65 provided that you have paid at least 10 years of contributions with a minimum of 120 months of coverage.

Be aware that if the qualifying period for a pension to be awarded at age 65 is not met, you are entitled to request a refund of the contributions paid into an account or continue on working. Early retirement is also possible:

-

- from age 57, if you can justify 480 months of compulsory insurance, which is in general terms the equivalent of having worked continuously from age 17;

- from the age of 60, if you can justify 480 months of compulsory insurance, continued insurance, voluntary insurance, retroactive buying-in periods and additional periods, including at least 120 months of qualifying periods of compulsory insurance, continued insurance, voluntary insurance and retroactive buying-in periods.

For more information on this topic, the National Health Insurance Fund (Caisse nationale d’assurance pension, CNAP ) should be your first port of call.

[…] a self-employed person may pursue an additional professional activity after the legal retirement age without this affecting his or her pension.

A self-employed person with a retirement pension is entitled to pursue a professional activity after the legal retirement age without this affecting his or her pension entitlements. On the other hand, in the case of an early old-age pension, the amount of income generated influences the granting, continued payout and calculation of the pension depending on whether it relates to paid work or not. If the income relates to a self-employed activity, the early old-age pension is withdrawn if the revenue spread over a calendar year exceeds one-third of the minimum monthly social wage, currently €901.25.

When calculating your statutory pension entitlements you must consider two things:

-

- flat-rate surcharges (linked to your annuities as an insured person, i.e. the maximum insurance period of 40 years);

- proportional increases (linked to your contributory income earned during the insurance).

The gross annual pension amount is then calculated according to the cost of living index and in relation to the baseline year 1984. The figure obtained is adjusted according to this index and the applicable revaluation factor. It is then divided by 12 in order to get the monthly amount.

The old-age pension cannot be less than 90% of the benchmark amount for an insured person with 40 years of contributions. In January 2025, this monthly minimum is €2,350.89.

By way of example: with a benchmark amount of €4,000 and 35 years of insurance, this is the formula to apply in order to calculate your annual minimum pension:

Benchmark amount x 90% x n/40 x index/100 x revaluation factor*

€4,000.00 x 90% x 35/40 x 9.4443 x 1.553 = €46,201.04 per year, or approximately €3,850.09 monthly

The minimum pension amount is reduced by 1/40 per year for a self-employed person who has not made 40 years of contributions, but at least 20 years.

If the amount obtained does not live up to your expectations, there’s still time to act! You can supplement your statutory pension with other contributions.

Pensions and additional income

Depending on your own personal goals and means, you could invest in your business, and purchase offices, stores or warehouses. Upon retirement, you could lease out these premises, using the rental income as compensation. An alternative that runs along the same lines is to sell any such premises immediately upon ceasing your professional activity in order to boost your savings.

You can also subscribe to a wide array of insurance products specific to your self-employed status and supplementary pension entitlements, which will offer you greater protection and provide you with an additional income upon retirement. This is an excellent way to compensate for any future discrepancies between your most recent income and statutory pension entitlements, while taking advantage of tax deductions on savings bonuses or death and disability premiums from now on. NB: A recent law provides opens the pillar II supplementary pension scheme to self-employed persons, subject to certain conditions.

To sum up, although the self-employed benefit from automatic membership of the state pension fund, it is important to make provisions insofar as possible for the capital and income you can rely on when you retire. A number of options exist if you wish to supplement your statutory pension entitlements, and it is up to you to make your choices according to your situation and means. Your banking advisor can guide you towards the solutions that best fit your profile. Never forget that the delivered information should always be considered based on your personal situation and may change with the legislation.

*1,553 for pensions commencing in 2025

Mortgage

Mortgage Personal loan

Personal loan Savings

Savings