Business start-up: making your project a success

Thinking about becoming an entrepreneur? Before taking the leap, consider things carefully. From idea to design and final product, planning each stage of the process will help guarantee the success of your project.

After a few years in the office, many dream of becoming their own boss. While entrepreneurial spirit and motivation are key, it’s important not to forget the legal and administrative side. By following just a few steps and avoiding certain pitfalls, you can give yourself every chance of success.

Make sure your idea is both clear and innovative

To successfully create a business, you should start from a solid base. Before you begin, take the time to define and develop your idea by studying the existing market, the competition and demand. Also, don’t be afraid to reach out to people you trust. At the same time, don’t let criticism discourage you. Instead, use any feedback received to consolidate your project.

The business plan, cornerstone of any project

Once you’re clear about your project, the serious business begins. Drawing up a business plan is the most important step for any entrepreneur who wants to launch a company. This document will let you answer the many questions that potential partners, suppliers, clients, bankers and investors may have. It’s also a roadmap and a way to convince. Since creating a business plan can be a lot of work, following a set structure can be a great help in addressing the human, strategic, financial and technical aspects involved.

Don’t forget about financing…

One of the biggest challenges facing any entrepreneur is finding the funds for his or her new project. Becoming an entrepreneur involves many costs. Financing the company’s share capital is usually one of the main funding requirements. The minimum amount depends on the legal form chosen for the company and can be as high as €30,000, contributed in cash or in kind.

You should also consider the costs of renting a workspace (shared office or commercial space), installation and equipment costs (hardware and software), as well as costs relating to support, accounting, insurance, licences, mobility and staff in particular.

To legally incorporate a company, an entrepreneur must have capital.

Useful info: in order to legally incorporate a company, an entrepreneur must have capital. Once the company has been set up, state aid may be available to help develop it further or deal with unforeseen circumstances. To receive state aid, a number of conditions must be met: the business must be established in Luxembourg and operate in the craft, retail, industrial, tourism or services sectors, and the application must be submitted before any investment or work is carried out.

These financial incentives can take the form of a capital grant, a recoverable advance, an interest subsidy, a guarantee, a loan or a (quasi-)equity contribution. They are typically earmarked for investments, advisory services, start-ups, and so on.

… and administration

Starting a business also involves administrative procedures. These include the application for a business permit, affiliation to organisations such as the Luxembourg Joint Social Security Centre (Centre commun de la sécurité sociale – CCSS), the payment of registration fees to the Luxembourg Registration Duties, Estates and VAT Authority (Administration de l’enregistrement, des domaines et de la TVA – AED) or the declaration of start of works. Some of these procedures may have a cost (e.g. chancery fees, notary fees or registration fees).

Make sure you don’t forget anything by consulting our administrative procedures checklist.

Find the legal form that suits your objectives

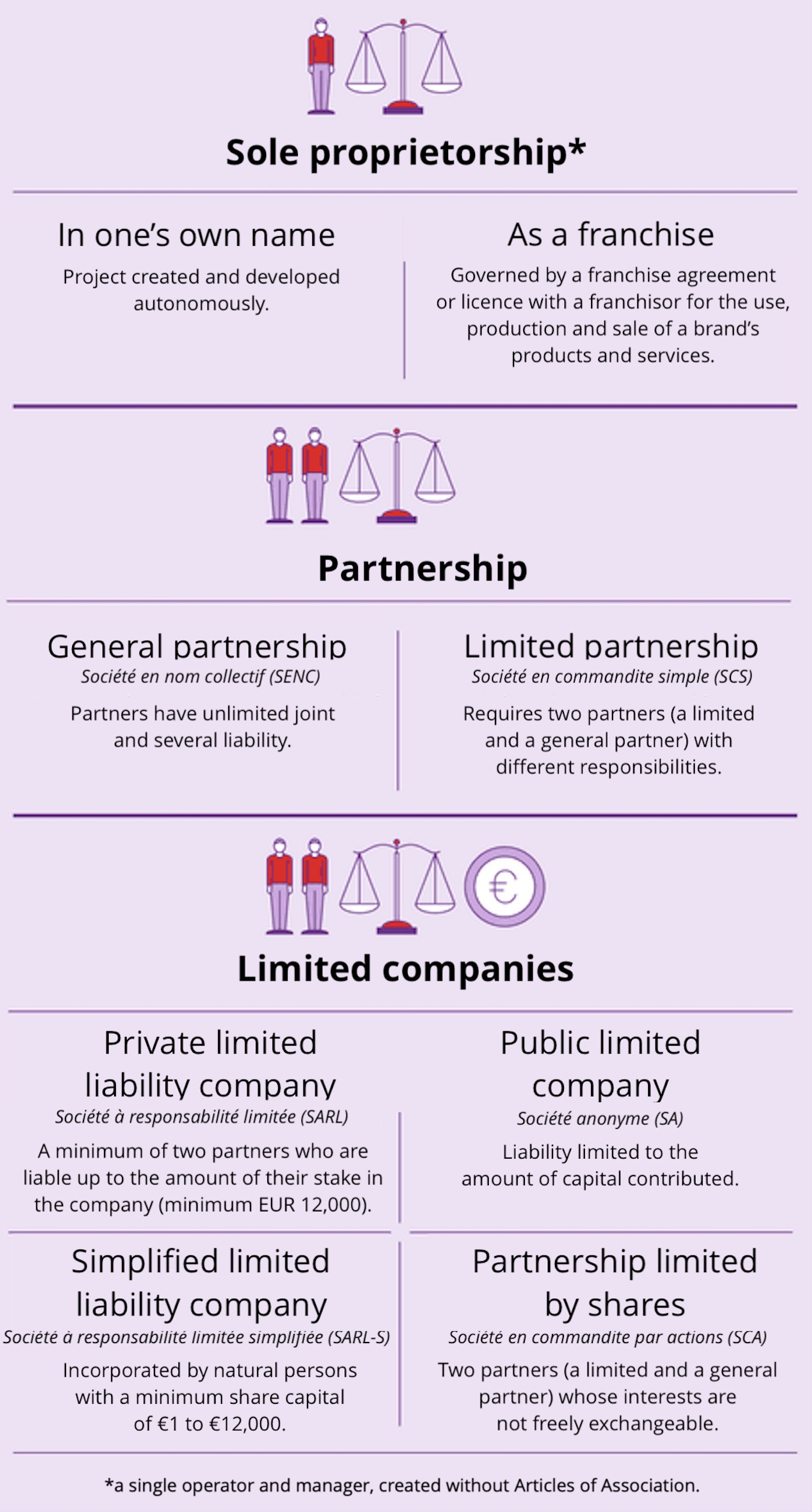

Another crucial question to ask is what legal form your business should take. A company’s legal form influences not only the entrepreneur’s liability, day-to-day management and the division of power, but also the tax treatment of investments made, income generated, and any losses incurred.

Entrepreneurs can set up their business as a sole proprietorship, or as a partnership or limited company (SENC, SCS, SARL, SARL-S, SA, SCA). Prefer working alone or with partners? Prepared to shoulder full liability? How much capital do you own? Complete freedom or the more structured framework of a franchise? To make the right decision, carefully go through your options with the help of a specialist.

Bear in mind that the legal form you choose will also have tax implications. In a sole proprietorship, you and your partners will be personally liable for tax on profits, whereas in the case of a company, the tax liability falls on the organisation and not on individual shareholders. The main taxes include registration fees, property tax, business tax, income tax and wealth tax.

Strong support, the key to success

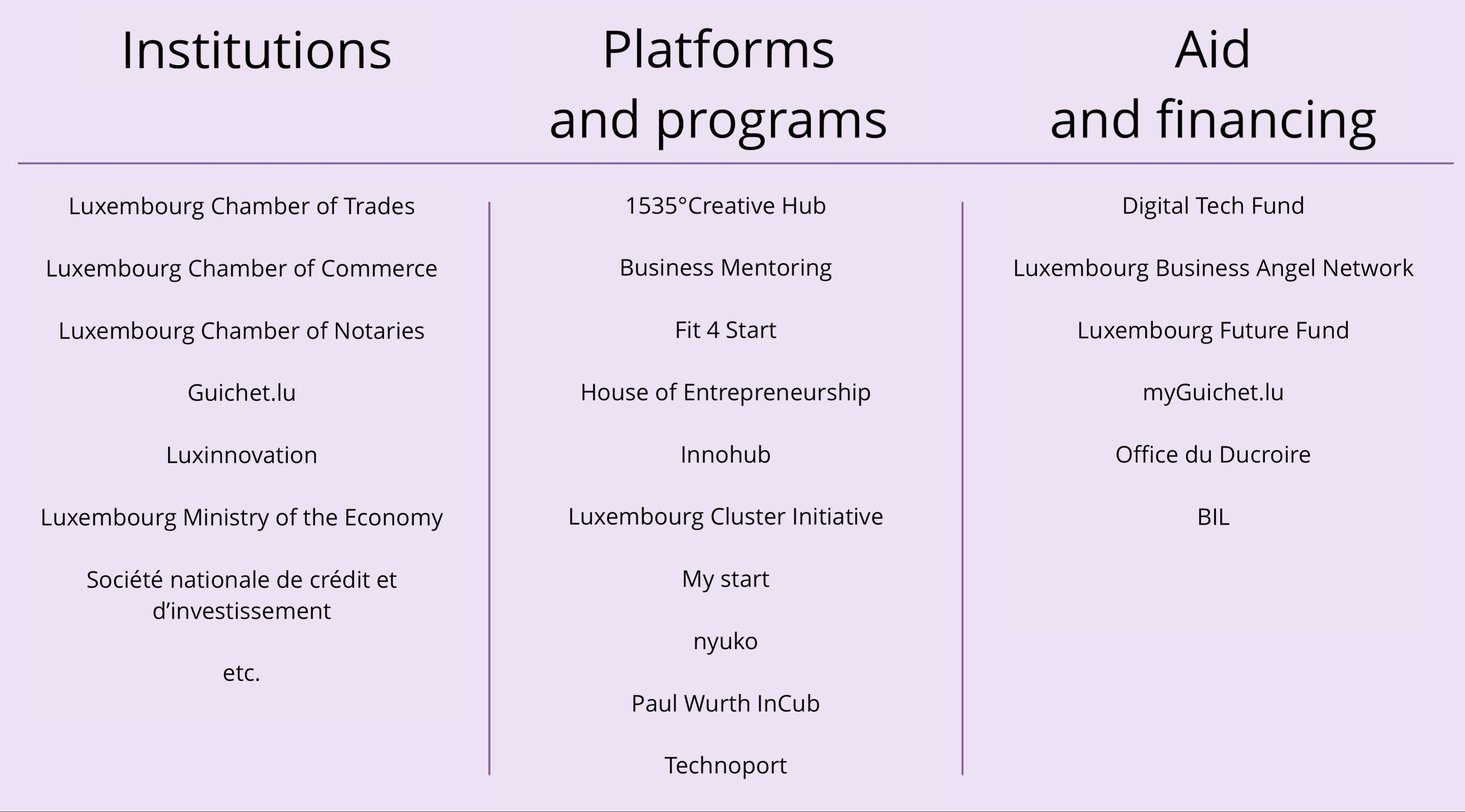

Starting a business isn’t something you do alone. A key ingredient of success is surrounding yourself with experts who provide good advice. Feel free to turn to support structures at any stage in the entrepreneurial process. Below you’ll find a non-exhaustive list of platforms that provide a helping hand and/or information.

Starting and developing your business

Once you’ve officially launched your business, some questions may remain. How long will it take to become operational? How can you sustain your company based on the results from its first year? Stay enthusiastic and focused: now it starts to get really interesting. Good luck!

Looking to start your own business? Take a look at our dedicated “business start-up” section.

Mortgage

Mortgage Personal loan

Personal loan Savings

Savings