Managing your budget with the 50/30/20 rule

It isn’t always easy to manage your budget properly. Bills, shopping, loan repayments, spending on the children, leisure purchases – sometimes it’s hard to know where you’re up to come month-end. And often, that’s when your savings suffer. Opting for the 50/30/20 rule will help optimise and simplify the way you manage your finances. myLIFE explains how it works.

There are many ways to organise your finances. One of these is the 50/30/20 budget rule. This simple method was popularised by US Senator Elizabeth Warren in her 2005 book All Your Worth: The Ultimate Lifetime Money Plan, and will help you develop a healthy and balanced approach to your budget.

What is the basis for the 50/30/20 rule?

This approach to budgeting works as follows: 50% of your income is allocated to needs – essentials and bills you have to pay; 30% goes to wants – non-essential spending on pleasure and leisure activities; and the last 20% is set aside for savings and investment.

This approach has the advantage of ensuring that you can cover your essentials and spend money on things that give you pleasure, without neglecting your savings.

-

- Needs: 50% of income

Needs are expenses that cannot be avoided – bills that have to be paid and things required for survival: rent, bills, overheads (water, gas, electricity), insurance, loan repayments, food shopping, healthcare costs, and expenditure related to transport, childcare, etc. - Wants: 30% of income

Wants are discretionary expenses that are not absolutely essential but which make life more fun: restaurants, holidays, cultural activities, shopping, a gym subscription, streaming services, etc. - Savings and investment: 20% of income

This last category covers your savings and financial investments: transfers to a savings account, contributions to a retirement savings plan or life insurance policy, stock market investments, etc. This spending category can also be used for the early repayment of debts.

- Needs: 50% of income

The advantage of the 50/30/20 rule when properly applied is that it ensures that you can cover essentials and spend money on things that bring you pleasure, without neglecting your savings.

Implementing this method of budget management

Let’s have a look at the example of Olivia. She is in her early thirties, and recently had a little boy called Mathéo. Previously, she never paid much attention to how she spent her salary. If there was any money left over at the end of the month, she invested it in a savings account. But her expenses have risen since the birth of her son, and she wants to keep tighter control over her budget.

The 50/30/20 rule may be a good starting point to help her achieve her objective. How should she go about this?

#1. Calculate her incomings

Olivia needs to make a list to arrive at the total amount of her monthly income sources (after tax): her salary, child benefits, rental income, support, etc.

#2. Define her outgoings

She should then make a note of her outgoings over recent months: direct debits, bank card payments, cash payments, etc. Everything should be included, even the most modest purchases: coffee from the machine, Friday pastries, etc.

> She should calculate the monthly cost of any quarterly or annual payments. The goal is to get an overview of all of her incomings and outgoings on a monthly basis.

Any purchases that can be omitted without serious repercussions should be included in the wants category.

#3. Classify her spending

All costs should then be allocated to one of three categories: needs – fixed and unavoidable costs; wants – discretionary and variable expenditure on leisure and pleasure; or savings and investment. Distinguishing between the first two categories may prove harder than it first appears. Although pasta and bread are essential staples, ready-made meals and biscuits are discretionary. On the other hand, a season ticket for the swimming pool is leisure spending and, in principal, a want, unless it is prescribed on medical grounds. In the latter case, it is essential and therefore a need. Olivia should assume that any purchases that can be omitted without serious repercussions should be included in the wants category.

At this point, she may become aware that her needs account for more than 50% of her budget, or that her saving is practically non-existent. She will therefore need to rebalance her spending to get as close as possible to the 50/30/20 split.

#4. Adjust her budget

Olivia should now try to adapt her spending to the 50/30/20 rule.

→ If her spending on needs exceeds 50% of her budget, she should check whether she can reduce some of those items, e.g. taking public transport to work, using click and collect for shopping, renegotiating her bank loan , reviewing her insurance policies, changing her telephone provider, etc. She may be living above her means. Does she really need a two-bathroom apartment or the latest model of a trendy car? Asking the right questions is helping Olivia to realise that much of her spending is less essential than she initially thought.

→ Although wants are discretionary items, they are important for our well-being. But spending on these items should not exceed 30% of the budget. To help her stick to this limit, Olivia could set aside this amount in cash each month to pay for her spending on leisure items. This will help her keep track of exactly where she is up to with her spending, and it will be easier to stick to her limit.

With the 50/30/20 rule, savings and investment are an integral part of the budget.

→ Savings and investment are often ignored until other items have been paid for, but with the 50/30/20 rule they are an integral part of the budget. To help her keep to this 20% minimum, Olivia could set up an automatic transfer out of her current account and into a separate account at the beginning of each month, and then allocate this to her savings and investments.

NB: Savings are essential for a young mother, so that she can deal with any unexpected costs and realise her short or longer term goals such as buying a house, paying for Mathéo’s education, providing for additional income for her retirement, etc. She should start by building and maintaining precautionary savings equivalent to 4-5 months of earnings. After this, she can diversify her savings into investment products.

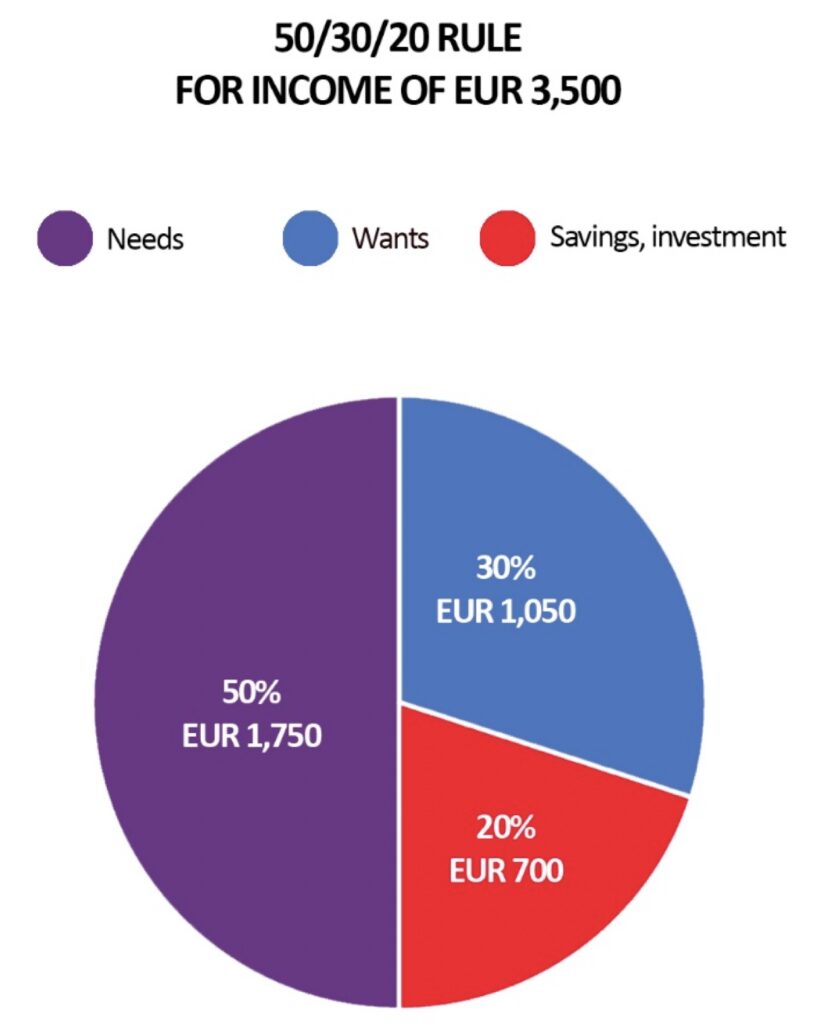

How to manage a budget with monthly income of EUR 3,500

With her salary and child benefits, Olivia has income of EUR 3,500 per month. To meet the 50/30/20 rule, she needs to split her spending as follows:

Please note that the percentages for the various categories are based on the optimum split. You can adjust this in line with your current priorities. The important thing is to stick to the three categories of spending, bearing in mind that the percentages allocated to needs and wants are maximums, whereas the percentage allocated to savings and investment is a minimum.

In conclusion, the 50/30/20 rule represents a starting point that should be adapted to your personal situation. However, for those on low incomes or with high debt levels, or, conversely, for anyone with a large salary, it is likely to be harder to respect this recommended breakdown. In this case, you should consider other budget management methods and choose the one that best suits your financial situation and objectives. And you can always ask for the benefit of your banker’s experience.

Mortgage

Mortgage Personal loan

Personal loan Savings

Savings