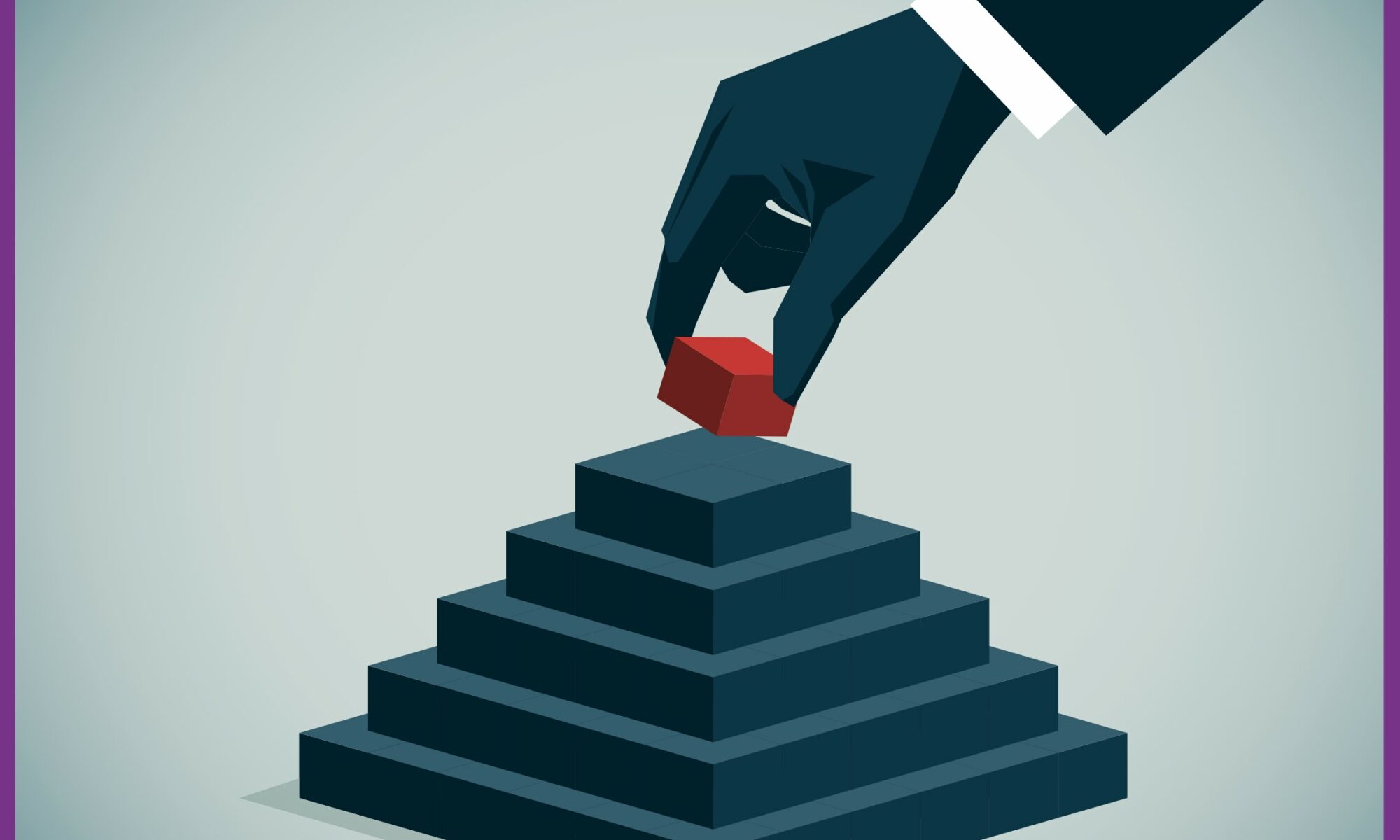

The investment pyramid

A good financial plan prepares for the worst, but hopes for the best. It creates a balance between protecting your position should you lose your job or fall ill and ensuring your wealth increases over time. It takes the form of a multi-layered pyramid, built on solid foundations but with the flexibility to generate growth once those foundations are well established.

It is tempting to believe that long-term wealth is all about having a particular amount of money, but the reality is more complex: how you plan to use your wealth should make a difference to how you manage it.

Time is important when managing your money. You can usually get a better return on your savings if you are willing to tie them up for a longer period. With term deposits, for example, banks offer a better interest rate on your savings than in an instant-access account. Depending on your risk appetite, a long-term approach also means you can invest in higher-risk assets such as shares because you can look beyond short-term volatility.

Why does volatility matter? The stock market can move around a lot in the short term. This was evident in early 2020, when markets saw a rapid sell-off in response to fear about the economic impact of the Covid-19 pandemic. The market recovered, but if investors had sold in February or March, they would have been nursing losses of 30% or more. This is why stock market investment is not usually a good option where savers are likely to need the money in the near term.

Having most of your money left in savings for any extensive period is a poor option to build wealth over time. Cash savings should be viewed as a home for short-term or emergency money.

However, having most of your money left in savings for any extensive period is a poor option to build wealth over time. With many cash savings accounts paying low interest rates, and the value of your money eroded by inflation, investors are liable to see the purchasing power of their savings drop as time goes by. Therefore cash savings should be viewed as a home for short-term or emergency money.

Foundation of a savings plan

It can help to view money as a pyramid. At the bottom, there is ‘rainy day’ money, a reserve to cover any contingencies – such as a leaky roof or an unexpected bill – or larger spending items, such as a car or a deposit on a home. This should be kept in cash because you might need to call on it at any time. No savings plan is complete without such a reserve in place, and it is the foundation for everything else.

It is worth choosing your savings account carefully; there has been a wider range of interest rates since the surge in inflation across much of the world in 2021 and 2022. Pick the most appropriate account for your needs and pay in small amounts regularly, for example by standing order. A good idea is to do this on the day you get paid every month so you don’t miss it.

Once this cash buffer is in place, you can start looking at longer-term savings and investment. This should include some measure of protection for your family in the event of a sudden loss in income, such as illness or redundancy. In practice, this is likely to mean life insurance and retirement savings.

Pensions and insurance

Retirement saving starts with pension arrangements. In Luxembourg, the public pension system provides retirement benefits with two components: a flat-rate amount calculated according to the number of years of contributions, plus an earnings-related element. This is paid for through contributions by employers, employees and the state, and benefit from tax breaks.

With contributions amounting to 24% of wages for employees (including the state’s 8%), the level of provision is high, but personal pensions and insurance products are also an option for those who would like to save more. The self-employed have a similar scheme to the main public pension system, but contribution rates are lower. In addition, some companies also offer their own supplementary pension arrangements as an employee benefit.

Insurance is a vital part of any financial plan. Many employees will have a death in service benefit and some sickness cover through their company, but it is useful to check how much this is actually worth and whether it would be sufficient to protect your family from financial hardship. Any shortfall can be topped up with life insurance, while income protection or critical illness insurance can cover your salary in the event of redundancy or ill-health.

Investing for lifestyle ambitions

The remainder of your wealth is likely to be directed towards financing other significant lifestyle ambitions – your children’s education, a ‘bucket list’ holiday or a second home. The right option will depend on your risk appetite, your knowledge and experience of financial products, how long you have to save, and how much you’re willing to put aside, but it is likely to involve a blend of investment products such as investment funds, shares and bonds, and possibly structured products.

For this part of your wealth, there is greater flexibility. You can afford to experience some volatility in the capital value of your investments, which means you can direct it toward assets that offer the possibility of higher growth. You need to decide how much risk you are willing to tolerate, whether you need an income from your investments (and when), and whether you have specific requirements about the way your money is managed, such as ethical or climate considerations. Your banker can help direct you toward the most appropriate personal options, and how your investments should be managed. whether that is discretionary management, taking your own investment decisions, or an advisory service in between.

In viewing your wealth this way, you can see how savings and investment interact. The investment portion is vital for building long-term wealth, but savers must get the foundations right before they can start to take risks with the rest of their money. In this way, a well-managed financial plan can help build both financial security and long-term wealth.

It is tempting to believe that long-term wealth is all about having a set amount of money. The reality is more complex: how you plan to use your wealth makes a difference to how you manage it.

Mortgage

Mortgage Personal loan

Personal loan Savings

Savings