Mortgages: how to negotiate the best interest rate

After several weeks of searching, Ed and Mel have found their dream home. The living room is spacious, the kitchen is kitted out, the master bedroom has an en-suite bathroom, and the garden and terrace offer plenty of privacy. They can’t wait to move in! But before they start thinking about decorating and the colour of the curtains, they have to consider financing. And our couple would welcome some advice on how to approach a conversation with their banker.

Ed and Mel have run a few loan simulations and they already know what they can afford. On this basis, they sign an agreement in principle for the house and make an appointment with their bank to negotiate the best loan terms.

With interest rates on mortgages having risen sharply since mid-2022, Étienne and Mélissa are doing their utmost to negotiate them. And there’s no question of waiting any longer when rates could well continue to rise. They can also compare several banking institutions (traditional banks, regional banks, cooperative banks, etc.) and pick whichever they like the best. It’s not always easy to negotiate, but nothing ventured, nothing gained.

How to negotiate an advantageous interest rate

It’s no secret that there are “good” and “not-so-good” applications from a bank’s perspective. When it comes to mortgage terms, banks don’t offer the same to everyone. Instead, the terms vary depending on factors such as the bank’s assessment of the applicant’s risk level. So, it’s in Ed and Mel’s best interests to make sure they’re well prepared for their meeting with their adviser.

What does the bank look for in an applicant and how can you improve your chances of getting the best possible interest rate on your loan? Banks take several factors into account:

Income and debt level

Ed and Mel must prove that they have enough income to cover their loan repayments. The bank will calculate the couple’s debt level to check what they can afford. Having a large, steady income will tip the balance in their favour because banks have to make sure that borrowers can pay off their loans without getting into financial difficulty.

It depends on a borrower’s income, but as a general rule the ratio between monthly income and loan repayments must be under 33%.

Useful info: It’s a good idea to have your salary paid into an account held with the bank granting the loan. Your relationship manager may be more inclined to give you a favourable rate.

Banks incur more risk on a 25-year loan than on a 15-year loan. That’s why interest rates rise as the loan term increases.

Mortgage deposit

To grant them the loan they want, the bank has asked Ed and Mel for a deposit of at least 10% of the value of the house. That tends to be the minimum amount required (at least 10-20% in Luxembourg) to cover all of the costs associated with the purchase (e.g. notary fees, administrative fees, etc.). Property prices in Luxembourg being what they are, this can be quite a lot of money. Luckily for our couple, they’ve managed to save up enough for a slightly larger deposit, which is another point in their favour when it comes to negotiating.

Useful info: If you have a larger initial deposit, the loan amount will be smaller and there will be less interest to pay. Plus, the longer your loan term, the more expensive it will be. Banks incur more risk on a 25-year loan than on a 15-year loan. That’s why interest rates rise as the loan term increases.

Banks tend to be more generous if you can show that you want to maintain a long-term banking relationship with them.

Bargaining chips

Banks tend to be more generous if you can show that you want to maintain a long-term banking relationship with them. As such, it’s in Ed and Mel’s interests to build up some leverage by, for example, taking out life insurance, home insurance, a savings plan, investing in shares or putting their money in an investment fund. This will work in their favour during the negotiation because the bank may be more willing to offer a competitive borrowing rate to a “good” client. All the same, the bank won’t decide to be more generous purely because a client has a longer list of products in their name – the key factor is how well the bank knows the client and their financial status.

Account keeping

For the past few months, Ed and Mel have been extremely careful with their money. They’ve worked hard to never dip into their overdraft and not to make useless or unnecessary purchases. They also paid off their personal loan before submitting their mortgage application. Their aim is to show that they are responsible when it comes to managing their accounts. As such, the bank will be able to take this into account when they draw up the terms of their mortgage. A responsible, organised client always makes a good impression. Of course, your banker will not decide whether or not to grant you a loan on their own. They will also need to submit your application to the bank’s lending committee to which they report and convince members to grant you a loan. Ed and Mel’s goal should be to give the banker plenty of strong arguments with which to make their case.

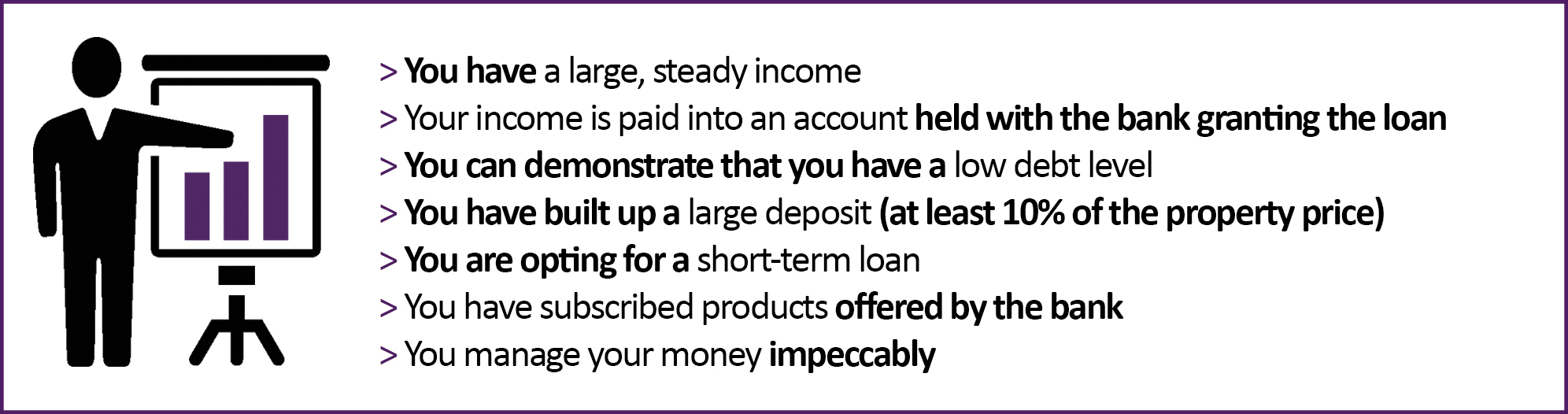

To sum up, if you want to give yourself a fighting chance to negotiate preferential terms for your loan, here’s an ideal scenario:

What else can you negotiate apart from interest rates?

When it comes to preferential loan terms, the borrowing rate is not the only point Ed and Mel might want to negotiate. As a general rule, their banker is likely to have room for manoeuvre on the following points:

- administrative fees

- early repayment fees : if a borrower has a fixed-rate loan, they’ll need to pay fees to the bank if they want to pay it off early. They can discuss the fee amount and try to have the rules relaxed. The financial stakes are high, so your banker probably won’t have the personal authority to be overly generous. They’re likely to need approval from their manager

- credit protection insurance: the bank will offer insurance to cover your mortgage if you were to pass away or become permanently incapacitated. While you can take out this type of insurance from any institution that offers it, choosing a policy offered by the bank granting your loan only makes your application stronger.

What about brokers?

To secure a competitive interest rate on their mortgage, Ed and Mel could also contact a broker. The broker will act as a go-between and find the best financing solution on offer on their behalf. This will save time for the couple because the broker will negotiate with the banks in their network. On the other hand, using a broker means paying brokerage fees, extra admin and, above all, ensuring that you’re dealing with a trustworthy professional. Typically, your broker won’t know you as well as your banker.

In the end, whether they opt to use a broker or not, Ed and Mel would do well to compare the various mortgages on offer and pick the most suitable solution. The first offer is not always the best.

Mortgage

Mortgage Personal loan

Personal loan Savings

Savings