New government aid for SMEs in Luxembourg

Are you launching a business in Luxembourg? Do you need financing to help develop your company or give yourself a leg up? Then you might be interested to learn that the government aid scheme for SMEs was reformed in 2018, with new measures added!

The draft law reforming government aid for small and medium-sized enterprises (SMEs) in Luxembourg was approved on 5 July 2018 by the Chamber of Deputies and entered into force on 9 August 2018. It aims to encourage the creation, acquisition, expansion, modernisation and rationalisation of businesses.

What has changed?

The new scheme modifies the current system, adapts certain existing measures and introduces new measures.

To be eligible for this aid, SMEs must be lawfully established in Luxembourg and hold a business permit (crafts, commercial, industrial and some liberal professions). The aid is granted subject to conditions and some activities and individuals are excluded from receiving it.

Applications must be submitted in writing BEFORE commencing construction works, purchasing equipment or making investments in relation to the project or activity in question.

You must now submit your application before investing

The government wants this aid to have an incentive effect. In other words, without this aid businesses would not have pursued the activity in question, or would have done so in a limited fashion. This means you are now required, in most cases, to submit your request in writing BEFORE commencing any construction works, purchasing equipment or making investments.

This is a significant change from how the aid scheme worked before the reform. Applications not submitted in advance are rejected!*

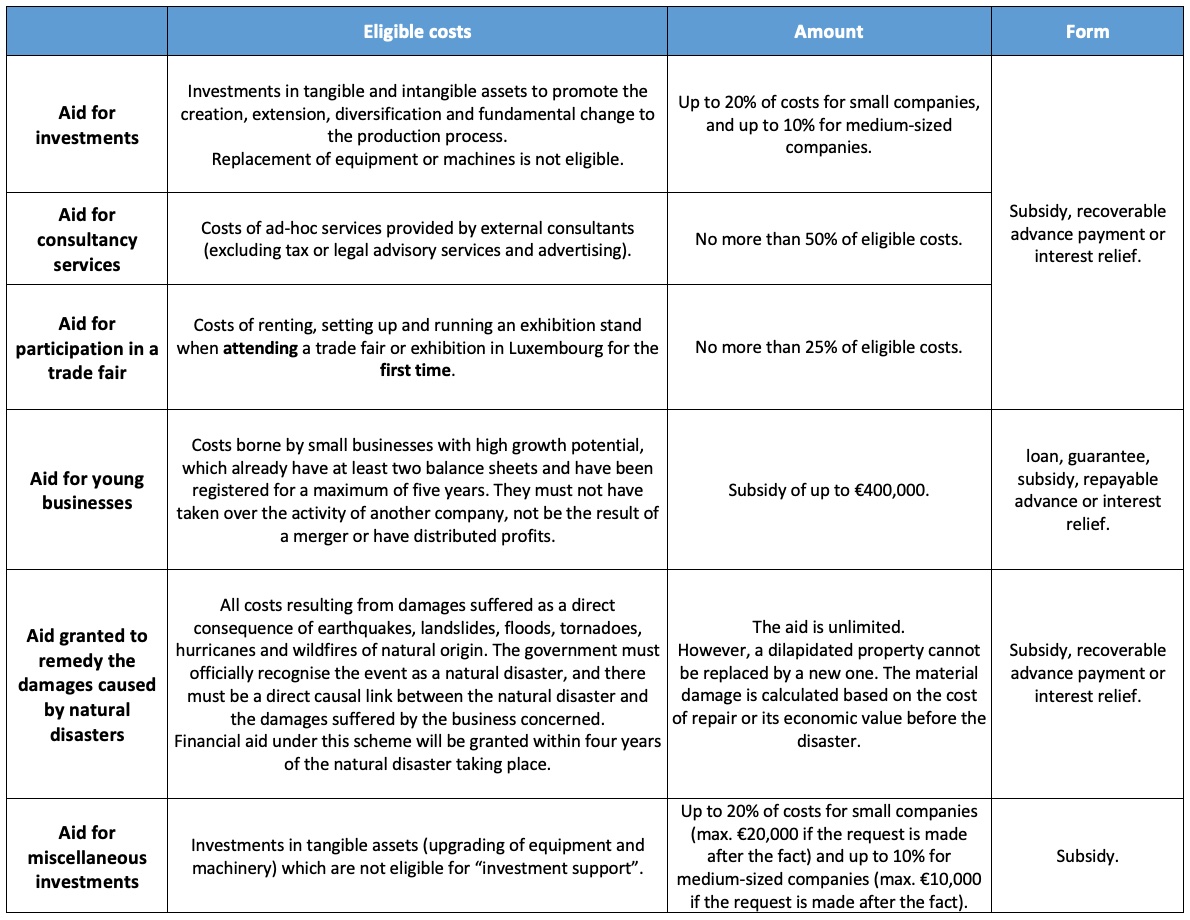

The different forms of aid

The state is able to provide financial support in a number of different ways. Depending on the aid requested, businesses will receive either a loan, a guarantee, a subsidy, a repayable advance or interest relief.

Remember: for each project, the minimum amount of financial aid is €1,000.

What is the new government aid scheme?

Faced with an ever-changing economic climate, the government is focused on boosting the competitiveness of SMEs and helping them enhance their performance. In this respect, the new scheme offers a number of different possibilities. Let’s take a quick look at the financial aid SMEs can receive.

Please contact the House of entrepreneurship if think you might be eligible for aid.

In addition to government aid, there’s also a whole host of other ways to finance your business, such as the SNCI (Société Nationale de Crédit et d’Investissement), bank loans, crowdfunding, private investors, and so on. For more details, check out this article: Funding your start-up in Luxembourg.

* A “miscellaneous investment aid” application can be made retrospectively (within the year of disbursement), but in this case it is capped.

Mortgage

Mortgage Personal loan

Personal loan Savings

Savings