The state pension alone is not provision enough

The self-employed must prepare particularly well for retirement

The matter of the state pension is relatively straightforward for employees, as contributions are automatically deducted each month. But what about the self-employed? Is it up to them to see to their pension? How do they pay their state pension contributions? Is taking out a personal plan worthwhile? We hope to answer these questions and to be of some assistance.

In Luxembourg, the self-employed, just like all employees, are automatically enrolled in the state pension. The statutory retirement age is 65 so long as compulsory contributions were paid for at least ten years; that is, 120 months in total.

Note that a self-employed person drawing the old-age pension is entitled to carry out an occupational activity after reaching the statutory pension age with no effect on the pension amount. However, if the pensioner is taking the old-age pension early, the amount of income earned through an occupational activity does indeed have an effect on the award, continuation and calculation of the pension, depending on whether this activity is carried out in the context of paid employment or not. If it is a self-employed activity, the early old-age pension is withdrawn if the income, spread over a calendar year, is more than one third of the statutory, monthly minimum wage; that is, currently more than EUR 901.25.

Calculation and contributions

Two components are considered when calculating the state pension amount: the flat-rate mark-up (which comes from the number of years the beneficiary contributed, up to a maximum of 40 years) and the proportional mark-up (which comes from the contributory income). The gross pension for a year is then calculated taking the cost-of-living index into account and adjusted based on the applicable revaluation factor. The old-age pension may not be less than 90% of a certain reference amount for beneficiaries who have a 40 year-record of contributions. In May 2025, the minimum state pension amount was EUR 2,350.89 per month.

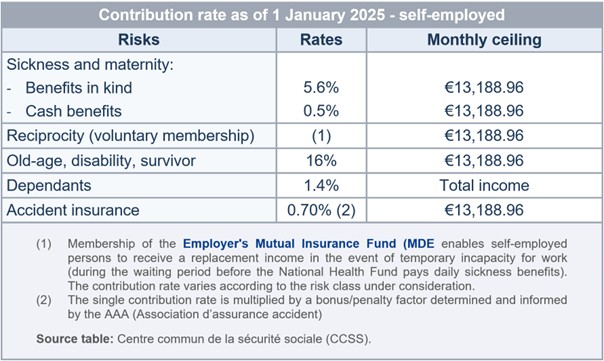

The contributions (see box) are calculated on the basis of the self-employed person’s most recent income or, in the case of newly insured persons, on the basis of the minimum contributory income. The basis for the calculation of these contributions may not be less than the statutory, minimum monthly wage of EUR 2,703,74 (May 2025).

Supplementary solutions make sense

Depending on their personal goals and means, it makes good sense for the self-employed to invest in commercial property for their business, with the aim of owning their offices, shops or warehouses. Then, when they retire, they can rent out these premises. This will supplement the state pension. Of course, an alternative is to sell the properties that they bought (thereby making a capital gain due to the higher property prices).

Incidentally, since 1 January 2019, the second pillar – the supplementary occupational pension – is open to the self-employed.

Another option is to take out one or more insurance policies designed especially for the self-employed or an insurance policy to yield a supplementary pension. These policies give protection while also supplementing the state pension. Such supplementary pensions are a good way of making up for the shortfall between your last earnings and the state pension amount. Plus, there are tax breaks on the savings or contributions to life and disability insurance. Incidentally, since 1 January 2019, the second pillar – the supplementary occupational pension – is open to the self-employed, albeit under certain conditions.

In summary, the self-employed must plan for retirement as carefully as possible. They have multiple options to supplement their state pension. They must decide on the model that suits them and keep abreast of the legislation, as changes in the law can open up new avenues.

Who qualifies as self-employed in Luxembourg?

“Self-employed” is an umbrella term that must be defined more precisely. Very generally, it refers to people who carry out an occupational activity for their own account. The following three categories, in the main, come under this heading: trades (such as bakers, hairdressers, etc.), commerce (such as publicans, restaurateurs, hoteliers, hauliers and a wide range of businesspeople) and personal services (e.g. lawyers, doctors, architects).

When they take up their activity, self-employed people must register with the social security office in order to receive social security benefits. These contributions are subsequently calculated based on the insured person’s income on the basis of the tax return they have submitted.

Mortgage

Mortgage Personal loan

Personal loan Savings

Savings