What if investing were a part of your everyday life?

Between work, family, household chores, shopping and outings, life can feel more like a sprint than a stroll. It’s not easy to juggle everything in your mind – and yet you still manage to attend your doctor’s appointments, find time to do a bit of sport, and remember to brush your teeth every day. In short, you take care of your physical well-being on a daily basis. Now what if you did the same for your financial well-being?

When we think about our budget, the countless expenses that need to be managed on a limited income are often what spring to mind: standing orders, one-off purchases, unexpected bills and little extras to treat yourself. We manage as best we can and then find there’s almost nothing left to put aside at the end of the month. Naturally, we tell ourselves that it’s time to show more budgetary discipline so that we can build up a little capital and allow it to grow. We’ve been thinking about this for a while, and this time we really mean it… but not until tomorrow.

I’ll start tomorrow!

We all have a tendency to over-value the present to the detriment of our future; to favour instant gratification over delayed gratification and the greater rewards it may bring. Projecting into the future needs you to be able to disregard the little things in favour of the big picture, which in turns requires greater discipline. And so we procrastinate instead of taking action. In behavioural finance, this intemperance – which is referred to as “present bias” – leads us to favour immediate consumption and to put off important decisions, such as drawing up a financial plan with a view to building up capital. Why? Because savings and investment products deprive you of resources available to you today so that you can benefit from additional resources tomorrow.

We all have a tendency to over-value the present to the detriment of our future; to favour instant gratification over delayed gratification and the greater rewards it may bring.

There is another cognitive bias that inhibits our motivation to save or invest: loss aversion. Taking the decision to save a certain amount each month will at first feel like an unpleasant reduction in disposable income. Our brains tell us that everything is fine and that it’s for our own good, but the loss we feel still acts as a powerful brake. The best remedy against this bias is to not have to make the effort of deciding every single month. How? By setting up a standing order to an account set aside exclusively for future investments. In other words: investing should be part of your everyday life!

But you still need to know how to save and invest. Proper management of your money requires a sound and balanced financial plan that helps you live well today, prepare for tomorrow and deal with any accidents or unexpected situations life might throw at you and your loved ones. This is more than achievable – as long as you do things in the correct order.

Guided by a solid financial plan

When it comes to saving and investing, there is no one-size-fits-all approach. On the contrary – the right strategy depends on several factors, such as your current situation, your available resources, your life plans and your investor profile. It’s also important to remember that investing in financial products carries the risk of capital loss, and that the tax benefits depend on your legal and tax situation. This is something you need to be aware of before you embark on your investment journey.

While there are thousands of investment possibilities, there is also a tried-and-tested approach for you to follow when it comes to building up capital gradually and making it grow.

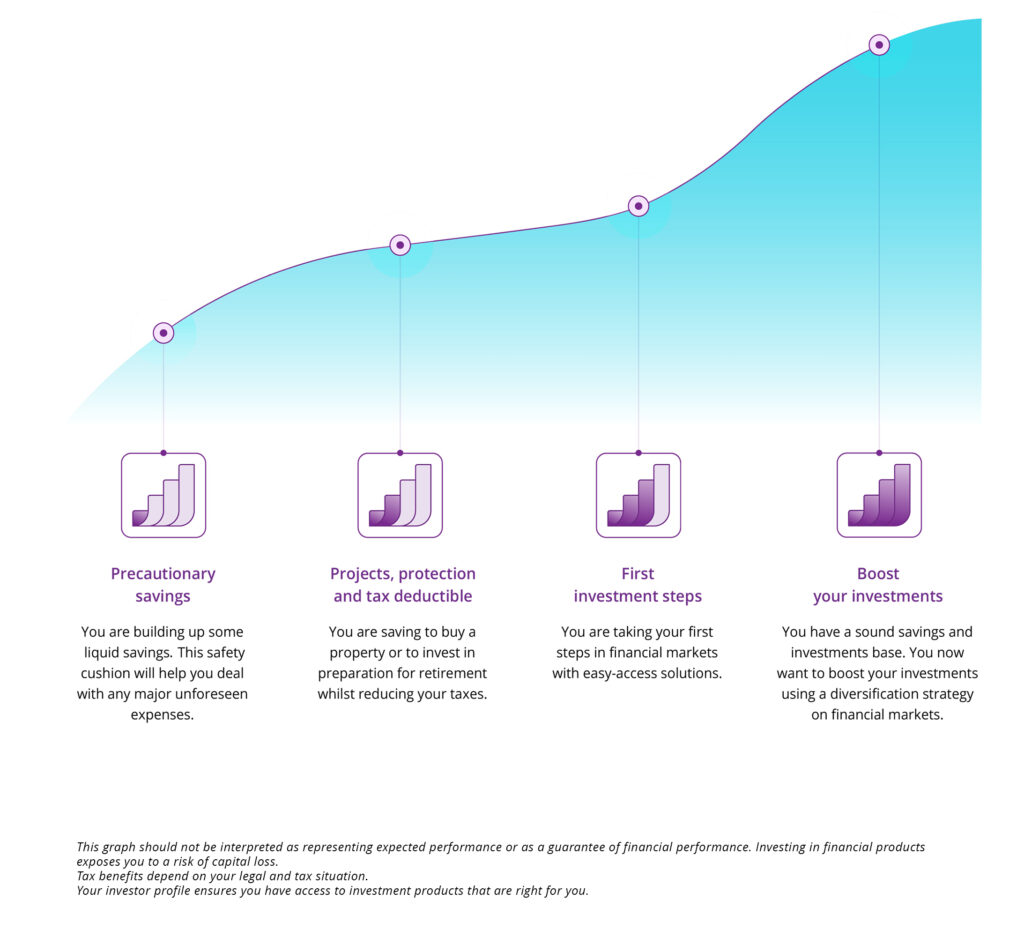

Before embarking on your investment journey, it’s important to have the investment pyramid in mind – or, to put it another way, to visualise the various logical stages of progression on the investment curve. While there are in fact thousands of investment possibilities, there is also a tried-and-tested approach for you to follow when it comes to building up capital gradually and making it grow.

-

- Step 1: precautionary savings. Can you afford to deal with your boiler breaking down, or any other unexpected bill? It’s important to have a safety net – such as a savings account that you pay into monthly via a standing order – to cover unforeseen circumstances.

- Step 2: protection and planning. Do you already have precautionary savings? Start planning your property purchase, preparing for your retirement or protecting yourself and your family. Depending on the solutions you choose, you may even be able to take advantage of tax benefits – allowing you to prepare for tomorrow by earning today.

- Step 3: the first steps in your investment journey. Do you have the resources to make further progress on the investment curve? The next course of action is to make your first foray into the financial markets by opting for a recurring investment in easily accessible solutions (e.g. flexicav) with a risk level suited to your investor profile.

- Step 4: boosting your investments. Now that you have a sound savings and investment base, you can diversify your investments and aim for greater profitability. The goal here is to give you the means to make certain life goals (second home, travel, etc.) a reality, even if it entails taking greater risks and accepting a degree of volatility in the value of the capital invested. Your banker can advise you on what option is best for you, whether that’s discretionary management, an advisory agreement or an execution-only formula that has the sole purpose of executing your investment orders.

Book an appointment with your banker today!

Do you know where you stand on the investment curve? Have you identified the cognitive biases that are preventing you from taking the plunge, and are you determined to stop falling victim to them? Now all that’s left is to get things started. There’s just one problem: you don’t have the time or the expertise to do it alone. So why not enlist the help of an expert? Don’t wait until tomorrow to ask for an appointment with your banker – arrange a meeting to review your situation, your profile and your objectives today. There are a number of advantages to having such a meeting.

-

- Tailored advice. Taking the time to discuss your savings and possible investments with a professional ensures you’ll be asking the right questions and benefitting from a tailor-made analysis, which in turn will enable you to determine the right measures to take given your situation.

- Expertise. A savings and investment professional will draw your attention to the products and services best suited to your needs, depending on where you are on the investment curve. They will suggest solutions you may not be aware of and help you to better understand how each solution works.

- No obligation. At the end of the meeting with your banker, you will remain completely free to make your own choices and be under no obligation. In short, it’s a discussion that costs you nothing and can greatly improve the management of your personal finances. Not only do you have nothing to lose, you also have everything to gain.

- A first step. Having a discussion with your banker is the first step towards better management of your personal finances – because even if you don’t decide on anything there and then, it will still help to solidify things in your mind. From there, it will be much easier to stop procrastinating and start moving forwards.

Would you like to take the plunge? Start today and make investing part of your everyday life. It’s the best way to put yourself on the road to financial freedom.

Mortgage

Mortgage Personal loan

Personal loan Savings

Savings