When planning for retirement, should you pay off your mortgage or invest more?

Like many people, you’re starting to wonder about how to finance your retirement and there’s one specific issue niggling away at you: should you focus on repaying your debts (e.g. your mortgage) or on investing? It’s worth spending a little time on this question, as the reply is not straightforward.

In financial terms, what do you think is the most pressing and important element in securing your future: eliminating debt on which you have to pay interest, or investing to increase your capital? Both are profitable of course, but which is best? Before answering, it’s key to take the time to properly understand the crux of the matter.

What type of debts do you have to repay, when and what will it cost? Is the cost spread evenly over time? And what type of investments are we talking about, and what are the related restrictions, risks and potential returns? Finally, in addition to all these questions, you will also need to get to grips with what may be a new concept for you: compound interest. This is something that we will specifically focus on in this article.

Start investing as early as possible…

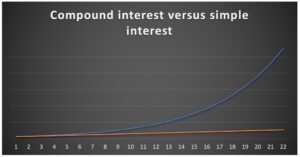

Every year the banks all spend a lot of time and advertising telling us that we need to get our finances ready for retirement as early as possible. myLIFE is no different and has even put together a special feature on retirement to help you with this. But why is it so important to invest early? The answer to this question is compound interest. If we disregard bank charges and the potential for negative interest rates, this principle can be explained as follows: one euro invested today is worth more than one euro invested five or ten years from now. The earlier a euro is wisely invested the longer it will be producing interest, which will in turn generate additional interest, and so on.

The earlier a euro is wisely invested the longer it will be producing interest, which will in turn generate additional interest, and so on.

This is the real difference to simple interest, i.e. interest calculated solely on the capital amount and without taking previously accumulated interest into account.

This means that postponing investing for your retirement has an exponentially negative impact with each passing year. That’s why investing for the future as soon as possible may be justified, rather than looking to pay off your debts early. We’re talking about investments here and not savings, i.e. you should choose investments with target returns that are higher than the interest rate on your mortgage, which, as we will see, also works on the principle of compound interest. In other words, the investment must generate a higher return than the cost of the debt over the period under consideration.

As an avid myLIFE reader, you will no doubt tell me that investments do not grow in a straight line and that markets are subject to fluctuations, which may result in losses. And that’s true! Returns are not generally fixed the way the interest rate on your mortgage may be, which is all the more reason to start early. Investing for the long term means your portfolio can handle periods of turbulence better. Historically, market have risen over the long term.

… or pay off your mortgage first

Having no financial debts is a comfortable position from which to safeguard your future. So it’s important to pay off your debts. But it isn’t always the best idea to pay them off early. This is particularly true for mortgages, for which the timing of early repayments is usually not the best.

Most people tend to think about full or partial loan repayments at the very end of the mortgage period. However, the interest burden is greatest at the start of the loan – generally in the first 7-8 years of a mortgage taken out for 20 years or longer. Even if the amount of your repayments remains constant each month (for a fixed-rate loan), the weighting of interest payments to capital repayments changes over time. You pay a lot of interest at the start and a lot of capital at the end of a mortgage. For one simple reason: as the balance of capital for repayment declines, so do the interest charges on this capital.

| Example

On a mortgage of EUR 500,000 with a fixed rate of 2% over 20 years, your repayments will be around EUR 2,530 per month if we ignore any handling fees. If we round up the calculations slightly, your interest burden will be as follows: In year 1, EUR 500,000 x 2% = EUR 10,000 of interest out of repayments of EUR 30,360 In year 2, EUR 479,640 x 2% = EUR 9,393 of interest out of repayments of EUR 30,360 etc. In year 20, EUR 30,360 x 2% = EUR 607 of interest out of repayments of EUR 30,360 |

As this example clearly shows, partial repayment at the start of the mortgage will result in a greater reduction in the interest burden over the lifetime of the loan. Once again, it’s the compound interest principle at work here, but in the opposite direction. The quicker the balance of capital for repayment declines, the quicker the compound interest burden falls. Early repayment towards the end of the mortgage will therefore have a limited impact on interest payments. So you should ask yourself whether it would be better to invest your free cash, rather than paying off your mortgage.

In summary, repaying your mortgage early, in part or in full, in order to prepare for the future makes most sense early on in the mortgage. However, there is another key element to consider before taking your decision: will there be penalty fees to pay on top of any handling fees? The bank has the right to ask the client to pay a fee if costs are incurred through the early repayment of the loan. To find out more, have a look at the myLIFE article, “Is it a good idea to pay your mortgage off early?”

And there is one last point that requires consideration – any potential tax deduction for the financing costs on a mortgage to purchase your main residence. Under certain conditions in Luxembourg, it is possible to deduct debit interest on a mortgage. You should include this in your calculation before deciding whether repaying your mortgage early is an interesting proposition or not.

| Should you increase your monthly repayments or invest the money?

If you’re not convinced that early repayment is a good idea, maybe you’re instead considering increasing the level of your repayments? If we go back to the example above, what would happen if you decided to make monthly repayments of EUR 3,000 instead of EUR 2,530 from the offset? You would save around EUR 21,000 in interest and repay your mortgage in 16 years and 3 months instead of 20 years. Not bad. But now let’s imagine that instead of increasing your monthly repayments by EUR 470, you invest this money each month over the same period at an annual return of 4%. Ignoring any associated costs, this investment would bring you around EUR 35,500 in interest after 16 years. Now that’s much better! And if you continue this for another 10 years, the total amount of interest earned after 26 years would be close to EUR 110,000 on top of the EUR 146,640 of accumulated capital. Over the long term, investing is more interesting, provided that you can actually achieve the targeted return. |

What’s the best option?

In an ideal world, it’s clear that investing seems to be a better option than repaying your mortgage early. Sure, but every situation is unique and the world is anything but predictable. So you need to take a decision based on your own situation, preferably with the support of a competent adviser to help you properly assess each option. This means taking into account the various fees and potential tax implications that we have not covered here.

This may lead you to conclude that the best solution for you is a compromise between investment and early repayment. This could take the form of regular investments to prepare for retirement, for example, via a retirement savings plan and the partial early repayment of your mortgage in its early phase, i.e. when repayments still have a significant impact on the overall interest burden.

It’s always a good idea to think about reducing your debts, but don’t lose sight of the fact that this is not necessarily the most profitable option over the long term.

In response to extremely volatile or unravelling markets, early repayment may also be advisable as a safer option, even if potentially less profitable. If you are a conservative investor and the interest rate on your loan is well above what you could hope to achieve by investing in low-risk investments, early repayment may also prove to be the best option. Once again, each situation is unique and you must decide for yourself what is best for you. These are complex issues and it is always advisable to seek the assistance of an expert so that you are able to take an informed decision.

And to close, there is not one right answer. It’s always a good idea to think about reducing your debts, but don’t lose sight of the fact that this is not necessarily the most profitable option over the long term. Investment is often the best way to achieve your financial objectives for a retirement that matches your expectations.

Mortgage

Mortgage Personal loan

Personal loan Savings

Savings