How can you maintain your purchasing power?

It’s not uncommon to hear on the radio or TV or read in the newspaper that inflation is having a negative impact on savings. But what does that actually mean? myLIFE has looked into this question and offers you a few tips on how to protect your savings.

Inflation refers to a general increase in the price of goods and services over a prolonged period of time. In Luxembourg, it is measured using the Consumer Price Index (CPI). This index estimates the average change in the value of a representative sample of products and services consumed or used by Luxembourg households (a “basket of goods”) over a given period of time.

As inflation rises, purchasing power falls, as we can purchase fewer goods and services with the same amount of money. In other words, inflation erodes the value of money. Conversely, when prices fall, we refer to this as deflation. For example, an annual inflation rate of 2% means that you have to pay EUR 1.53 euros today for a croissant that cost EUR 1.50 a year ago.

Inflation can be caused by a number of factors, including an increase in the price of commodities, imported products or wages resulting in rising production costs inciting companies to push up their prices; demand for goods and services outstripping supply so that prices rise due to product scarcity; a fall in the value of the currency versus other currencies resulting in higher import prices. Another inflation driver is the money supply that is in the market. Higher money supply in the market causes depreciation in the value of money and leads to higher prices.

Impact of inflation on savings

Inflation has an impact on your savings, not just prices. When the inflation rate exceeds the interest rate on your savings account, you essentially lose money. Although the amount invested on the savings account rises, your purchasing power falls. Your savings must grow at the same rate as inflation to maintain your purchasing power

Inflation can be caused by a number of factors.

For example, if you deposit EUR 10,000 in a savings account with a nominal interest rate of 3%, ten years later you will have around EUR 13,439 in your account. If inflation was 4% per annum during this same period, you would need EUR 14,802 to have the same purchasing power as ten years earlier. Even taking account of the accumulated interest, your purchasing power has declined by 10%.

In Luxembourg, inflation is offset by wage indexation, i.e. the automatic adjustment of wages and pensions based on price fluctuations. So when price rises exceed a certain threshold, all incomes rise by 2.5% to offset the rise in the cost of living. However, in contrast to wages and pensions, the nominal interest rate on savings accounts does not necessarily follow the inflation trend.

What is a real interest rate?

In order to determine whether your investments are losing value, you can calculate their real return, by measuring the real return (real interest rate) after correction for the impact of inflation. By definition, this is the interest rate that indicates how an investment or other asset performs under the influence of inflation. Put simply, this means: Real interest rate = nominal interest rate – inflation. This formula allows you to do a quick estimate of the real interest rate you can expect to earn. There is a more detailed, precise formula that incorporates compound interest into the calculation.

In Luxembourg, interest rates on savings products have risen compared with their low level at the start of 2022. For its part, the Statec has communicated an inflation rate of 2.1% for 2024 and an inflation forecast of 2.2% for 2025. If, for example, your savings account pays 1.8% interest over one year, but prices rise by 2.1%, the real rate is: 1.8% – 2.1% = – 0.3%. The real return on your investment is therefore negative, and your savings are losing value. If we go back to our example of EUR 10,000, in ten years, the purchasing power of the amount invested on your savings account will be equivalent to around EUR 9,704 in today’s values.

Therefore, it is not really appropriate to leave all your money in savings accounts currently, as your capital is slowly being eroded over time. This could create problems if you are saving in order to finance a specific project, create a source of additional income for retirement

Diversify your investments

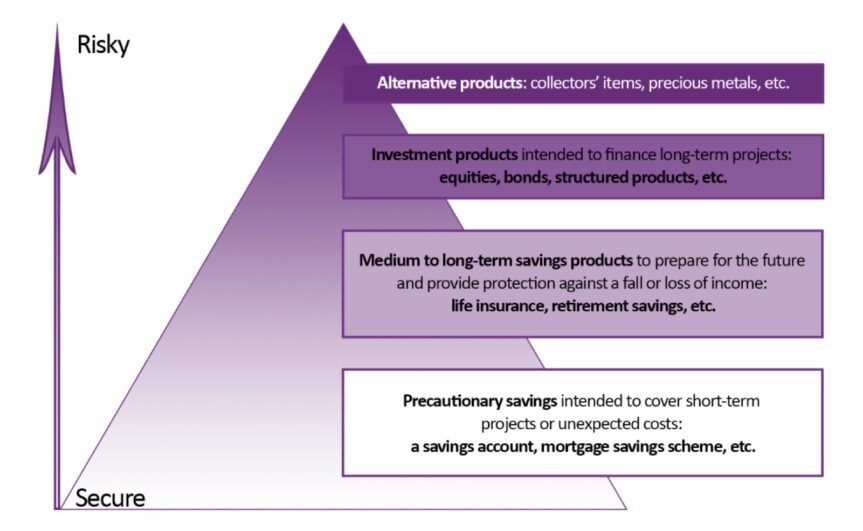

In order to maintain your purchasing power and reduce the risk of loss, it is important not to put all your eggs in the same basket and to diversify your investments. Managing your capital like a multi-level pyramid can help you balance your need for financial security with growing your savings

At the base of this investment pyramid, we have short-term, liquid investments that are easily accessible and secure. As we rise towards the peak of the pyramid, we have longer term investments that are less easily accessible and higher risk, but generally have a higher return.

Equities may help offset the impacts of inflation thanks to the potential for higher returns.

Equities may help offset the impacts of inflation thanks to the potential for higher returns. Potential dividend payments are also worth bearing in mind. However, make sure to carefully choose the securities in which you wish to invest, and don’t lose sight of the risks involved.

Real estate tends to move in line with inflation over the long term. In Luxembourg, prices have long risen faster than inflation, but the sector is experiencing a slowdown. Everything depends on the location and type of housing, but a bricks-and-mortar investment can help prevent your assets from losing value in real terms, provided that the market recovers relatively quickly.

Alternative investments such as commodities (wood, energy, agricultural products, etc.) and in particular gold – considered a safe haven – can protect part of your capital from any monetary devaluation. Luxury goods (works of art, collectors’ items, fine wines, etc.) may also offer protection against the impacts of inflation.

Mortgage

Mortgage Personal loan

Personal loan Savings

Savings