The negative impacts of inflation on your savings

Did you know that when prices rise for everyday goods it has a direct impact on your savings, and that the money you have set aside in savings accounts is gradually losing its value, given current interest rates? myLIFE explains the impact of inflation on your nest egg, and offers a few tips on how to protect it.

In the 2000s, a loaf of bread cost EUR 1.10 and a cinema ticket EUR 6.20, whereas today, the same loaf will cost you at least EUR 3.00 and an outing to see a film on the big screen EUR 12.30. This price hike is due to what we refer to as inflation.

What is inflation?

Inflation refers to a general increase in the price of goods and services over a prolonged period. In Luxembourg, it is measured using the Consumer Price Index (CPI). This index estimates the average change in the value of a representative sample (a “basket”) of household consumer goods between two periods.

As inflation rises, purchasing power diminishes, as we can purchase fewer goods and services with the same amount of money. In other words, inflations erodes the value of money. Conversely, when prices fall, we refer to this as deflation.

For example: If annual inflation is 2% and you were able to purchase two croissants for EUR 2 (EUR 1 per croissant) a year ago, today you will only be able to buy one croissant (at EUR 1.02 per croissant), for two you would need EUR 2.04.

Inflation can be caused by a number of factors, including:

-

- an increase in the price of commodities, imported products or wages resulting in rising production costs inciting companies to push up their prices;

- demand for goods and services outstripping supply so that prices rise due to product scarcity;

- a fall in the value of the currency versus other currencies resulting in higher import prices;

- higher money supply in the market causing depreciation in the value of money.

How much of an impact does inflation have on your savings?

Inflation has an impact on your savings, not just prices. When the inflation rate exceeds the interest rate on a savings account, you lose money, because the value of the money you have invested falls. Although the amount invested on the savings account rises, your purchasing power falls. Your savings must grow at the same rate as inflation to maintain your purchasing power.

For example: If you deposit EUR 10,000 on a savings account with a nominal interest rate of 1.5%, ten years later you will have around EUR 11,605 on your account. If inflation was 3% per annum during this same period, you would need EUR 13,439 to have the same purchasing power as ten years earlier. Even taking account of the accumulated interest, your purchasing power has declined by EUR 1,834. That is an enormous amount!

In order to determine whether your investments are losing value, you can calculate their real return, by measuring the real interest rate they are earning after correction for the impact of inflation.

In Luxembourg, inflation is offset by wage indexation, i.e. the automatic adjustment of wages and pensions based on price fluctuations. So when price rises exceed a certain threshold, all incomes rise by 2.5% to offset the rise in the cost of living. However, in contrast to wages and pensions, the nominal interest rate on savings accounts does not necessarily follow the inflation trend.

In order to determine whether your investments are losing value, you can calculate their real return, by measuring the real interest rate they are earning after correction for the impact of inflation. There is a precise formula1 for calculating the real interest rate exactly, but it is also possible to do a quick estimate on an approximate basis, by subtracting the inflation rate from the nominal interest rate on your savings account: Real interest rate = nominal interest rate – inflation.

In Luxembourg, interest rates on savings products have risen significantly compared with their level at the start of 2022. In May 2023, the Statec published an inflation forecast of 3.9% for 2023. For example, if your savings account generates interest of 2.5% per annum but prices are rising at 3.9%, the real interest rate is: 2.5% – 3.9% = -1.4%. The real return on your investment is therefore negative, and your savings are losing value. If we go back to our example of EUR 10,000, in ten years, the purchasing power of the amount invested on your savings account will be equivalent to around EUR 8,685 in today’s values.

Therefore, it is not appropriate to leave all your money in savings accounts currently, as your capital is being eroded over time. This could create problems if you are saving in order to finance a specific project, create a source of additional income for retirement, or give a little help to your children.

Often, we do not realise what impact inflation is having on our savings. This is what we call money illusion: you watch your capital slowly growing on your savings account, but don’t realise that your purchasing power is declining over the long term.

In order to maintain your purchasing power and reduce the risk of loss, it is important not to put all your eggs in the same basket and to diversify your investments.

Diversify your investments to protect your savings

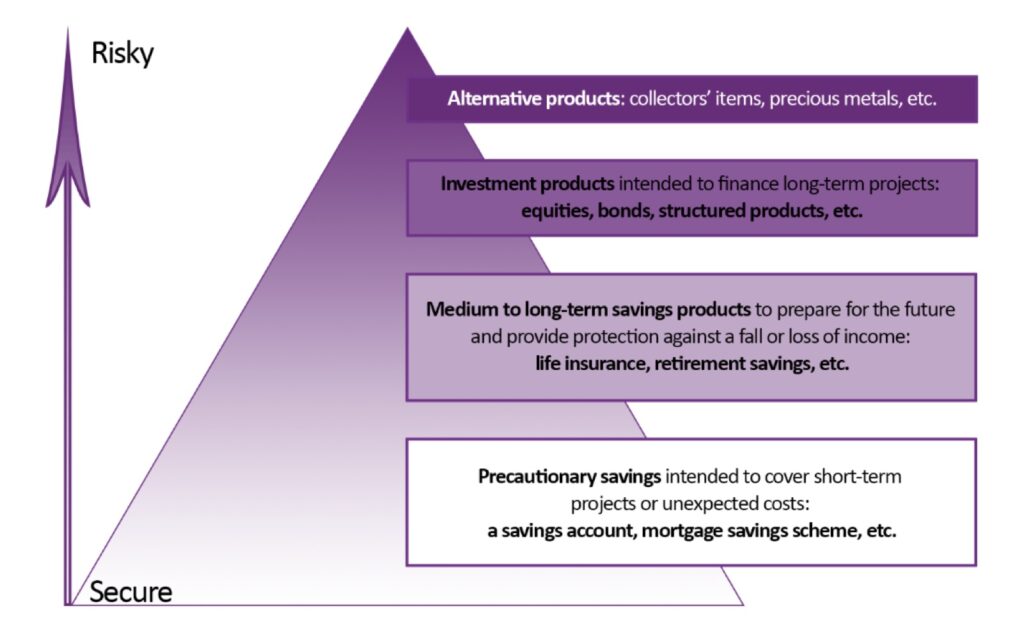

In order to maintain your purchasing power and reduce the risk of loss, it is important not to put all your eggs in the same basket and to diversify your investments. Managing your capital should therefore be structured like a pyramid, with several levels to balance your need for financial security and the growth of your savings.

At the base of this investment pyramid, we have short-term, liquid investments that are easily accessible and secure. As we rise towards the peak of the pyramid, we have longer term investments that are less easily accessible and higher risk, but generally have a higher return.

Your strategy thus needs to include several types of investment in order to improve the return on your savings and limit the impacts of inflation: a savings account, life insurance, retirement savings plan, financial products, alternative investments, etc. The aim is to find a good balance over the medium and long-term between secure and higher risk investments, bearing in mind your objectives and risk profile. This will require a chat with your banker!

Diversify your assets by investing part of your savings in products with better returns than those offered by secure savings accounts.

A few tips on protecting your savings from the impacts of inflation

In order to protect your savings from the impacts of inflation and grow your capital wherever possible, diversify your assets by investing part of your savings in products offering better returns than those offered by secure savings accounts. You could also invest in higher risk alternative investments and real (tangible) assets that will hold their intrinsic value.

-

- Equities may help offset the impacts of inflation thanks to the potential for higher returns than secure investments. Potential dividend payments are also worth bearing in mind. However, make sure to choose the securities in which you wish to invest carefully, and don’t lose sight of the risks involved.

- Real estate tends to move in line with inflation over the long term. In Luxembourg, prices have long risen faster than inflation, but the sector is experiencing a sharp slowdown. Everything depends on the location and type of housing, but a bricks and mortar investment can help prevent your assets from losing value in real terms, provided that the market recovers relatively quickly.

- Alternative investments such as commodities (wood, energy, agricultural products, etc.) and in particular gold – considered a safe haven – can protect part of your capital from any monetary devaluation. Luxury goods (works of art, collectors’ items, fine wines, etc.) may also offer protection against the impacts of inflation. Where necessary, make sure that you have the support of experts so that you can make an informed investment.

- etc.

NB: These investments may help combat any savings erosion, but the fact remains that certain of these can sometimes entail a high element of risk, and/or are the preserve of sophisticated investors! In addition, some investments are relatively illiquid and require a long-term horizon.

You now know the potential impacts of inflation on your savings. While traditional savings products are indispensable, alternative solutions may be worth considering to help you protect your assets.

Why not have a chat with your banker, who will help you identify the savings and investment products best suited to your situation, and the level of support you require.

1 The real interest rate is calculated using the following formula: [(1+the nominal savings rate) / (1+ the inflation rate)] – 1.

Mortgage

Mortgage Personal loan

Personal loan Savings

Savings